Use Cases

DLT Settlement Networks For Smarter Liquidity Management

DLT Settlement Networks for Smarter Liquidity Management

Industry-led digital networks delivering advanced DLT settlement orchestration and liquidity management capabilities

The Future of DLT Settlement

In today’s interconnected settlement landscape, the challenges of managing liquidity, collateral, and payments often exceed what any institution can handle alone. Baton is empowering the industry to overcome these barriers through collaborative, industry-led networks built on institutional-grade DLT settlement technology.

By connecting market participants through coordinated workflows and providing advanced settlement orchestration capabilities, participants can seamlessly collaborate and safely move money and assets in real-time – optimising settlements and unlocking liquidity efficiencies that far surpass what any firm could independently achieve.

Powered by DLT that has already settled more than $13 trillion, Baton is working with the industry to prepare for the future of liquidity management.

Discover how Baton’s DLT is powering a collaborative PvP network that’s reducing settlement risk and bolstering liquidity efficiencies for cross-border payments.

Why Baton’s Institutional-Grade DLT Powers Smarter, Faster Networks

Baton’s DLT-inspired Shared Permissioned-Ledger integrates seamlessly with existing systems, and is now being used to enable industry-led settlement orchestration and liquidity management networks that prioritise flexibility, transparency, and scalability.

Transparent and Collaborative DLT-powered Networks

Baton’s DLT settlement technology empowers networks that facilitate transparency and collaboration across institutions by creating tamper-proof records and enabling real-time interaction based on agreed rules of engagement.

- Transparency: All transactional workflows are fully captured and securely hashed, creating an immutable record and audit trail for regulatory and operational confidence.

- Interoperability: Built on open architecture with interoperable tooling and workflows.

- Collaboration: Institutions can seamlessly exchange information and settle transactions in real time, breaking down silos and improving cross-party coordination.

- Confidence: Baton’s platform creates a shared, tamper-proof source of truth, empowering institutions to make informed decisions with enhanced accuracy.

Advanced Settlement Orchestration Capabilities

Baton’s DLT-driven networks allow participants to integrate settlement orchestration capabilities to enhance operational and capital efficiency, including:

- Distributed Workflows: Intelligent, automated, real-time processes that streamline operations and foster counterparty collaboration.

- Automated Netting and Payment Splitting: Configure collaborative workflows that alleviate liquidity pressures and enhance funding cycles.

- Dynamic Settlement Sequencing: Align settlements seamlessly with funding and liquidity cycles across global markets and time zones, recycling funds more efficiently and reducing capital immobilisation.

- On-Demand Conditional Settlements: Achieve atomic Payment vs Payment (PvP), Delivery Vs Payment (DvP) and Delivery Vs Delivery (DvD) settlements, reducing risk, increasing business capacity and conserving liquidity.

- Dynamic Routing: Integrate and orchestrate settlements across traditional and digital settlement rails.

Seamless Integration for Maximum Flexibility

Baton DLT settlement technology has been built to deliver choice and flexibility, enabling the industry to build dynamic interoperable networks ready to adapt to a changing settlement ecosystem:

- Robust APIs: For streamlined connectivity.

- Pre-Built Connectors: Supporting banking platforms and nostro accounts.

- Protocol Compatibility: Including FIX, SWIFT, and ISO 20022.

- Digital Asset Connectivity: Integrating with a range of tokenised settlement systems to support settlements across fiat and tokenised flows

Customisable, Scalable, and Secure Architecture

Baton’s modular, cloud-native DLT settlement infrastructure is designed to adapt to your needs, providing networks with scalability and resilience.

- Scalability: Dynamically adjusts to growing transaction volumes with low latency.

- Security: Advanced encryption, secure access protocols, and key storage management safeguards sensitive data.

- Customisable Workflows: Low/no-code tools allow institutions to tailor processes with ease.

How It Works

1. Collaborate Seamlessly

Access shared workflows for real-time data visibility and settlement collaboration. All data is notarised, encrypted, and immutable.

2. Automate with Intelligence

Replace manual, error-prone processes with fully automated post-trade and DLT settlement workflows with continuous, automated payment netting and splitting, eliminating manual processes, delays and liquidity inefficiencies.

3. Settle with Confidence

Leverage on-demand, instantaneous, conditional settlement orchestration for safe, and final settlement across currencies and time zones.

Future-Proof Your Business and Join the Post-Trade Revolution – with Baton’s DLT-powered collaborative networks

Financial institutions need more than speed in today’s complex global markets – they require unparalleled control, flexibility, and transparency. Baton’s DLT-powered networks are designed to help the industry embrace the future of finance:

-

Seamlessly transition from fiat-based systems to always-on digital asset markets

-

Lead innovation with proven institutional-grade DLT settlement technology

-

Enhance liquidity, eliminate inefficiencies, and achieve unmatched precision

Ensure your firm joins the smarter, collaborative networks driving the digital economy. Request a meeting today to see how Baton is shaping the future of financial innovation.

The Eligibility Service

Enable Smarter Decisions with Best-In-Class Data on Eligible Collateral

Streamline and enhance the process of evaluating collateral eligibility with Baton’s Eligibility Service, enabling accurate and informed decision-making

Eligible Collateral Evaluation: Simplified and streamlined

Collateral optimisation hinges on accurately evaluating eligible collateral, yet many institutions still rely on outdated manual processes to collect and communicate this information, increasing cost and risk. These slow and inefficient processes can fuel delayed decision-making; result in over-pledging higher-cost assets (or even mistakenly pledging ineligible collateral assets) and a reliance on pledging high-quality liquid assets (HQLAs) to mitigate the risk of lower-liquidity assets being rejected.

The impact? Missed opportunities, risk exposure and inefficient financial resource management. You now have the opportunity to rethink your firm’s approach to evaluating collateral eligibility.

Baton’s Eligibility Service simplifies and streamlines the complex process of assessing collateral asset eligibility across diverse counterparty requirements for cleared derivatives, bilateral agreements, and tri-party arrangements.

With real-time insights on asset eligibility, fees, rates, and settlement windows, collateral managers can reduce errors and make confident, more informed funding decisions. Baton’s Eligibility Service transforms the process of eligible collateral evaluation, increasing speed, precision, and cost-efficiency for both cash and non-cash assets. Empowering financial institutions with unparalleled clarity and control, firms can optimise collateral allocations while driving superior operational efficiency and scalability.

Why Choose Baton for Eligible Collateral Evaluation?

Baton transforms collateral eligibility management with a streamlined platform that simplifies and automates complex collateral evaluation matching processes. Designed to accommodate intricate variations in eligibility criteria across venues, accounts, and product types, Baton ensures efficiency and precision at every step.

By normalising highly complex counterparty data, received in a wide range of formats with varying levels of detail and unpredictable update frequencies, Baton provides clear, consistent, and efficient access to counterparty schedules. Our advanced methodology ensures accurate evaluation of even the most complex schedules, supported by ongoing monitoring to ensure changes are rapidly identified and reflected. This commitment enables clients to evaluate collateral eligibility with confidence and ease.

Minimise Risk

Exposure

- The Eligibility service, integrated with Baton’s Core-Collateral Long Box, mitigates the risk of pledging ineligible or high-risk assets and their subsequent rejection or penalties. Instead, eligible assets can be clearly identified and secured in advance.

Real-time Collateral Asset Haircut and Fee Transparency

- Gain visibility into haircuts and fees imposed by counterparties on pledged assets.

- Evaluate interest rates offered by counterparties for cash assets to make informed decisions.

Optimise Collateral Management

- Seamlessly integrate the detailed information provided by Baton’s Eligibility Service into your optimisation processes. Elevate asset portfolio recommendations by ensuring they are based on accurate and well-informed eligibility assessments across venues and counterparties for the specific account and product type.

Enhanced Decision-Making and Cost Factor Analysis

- Automatically compare haircuts, collateral fees, cross-currency adjustments, and interest rates across counterparties to discover cost-effective opportunities that manual collateral eligibility assessments often overlook.

- Use counterparty availability data to optimise eligible collateral movements, avoid rejections, and calculate asset cost factors seamlessly.

- Ensure optimisation algorithms are using the most accurate and comprehensive collateral eligibility criteria.

Maximise Operational Efficiencies

- Introduce real-time, automated workflows and collateral eligibility checking processes to streamline operations and eliminate time-consuming manual tracking of collateral eligibility schedules.

- Access normalised counterparty eligibility schedules across multiple formats and channels and instant data on asset acceptability and haircuts across counterparties for faster decision-making – saving time and resources.

Effortless and Centralised Collateral Eligibility Evaluation

- Instantly access results such as haircuts, CUF (Collateral Utilisation Fees), interest rates, cutoff times, holiday schedules, and counterparty availability windows.

- Assess your lists of cash and non-cash assets to determine their acceptability as eligible collateral across multiple counterparty criteria.

- Alternatively, you can directly consume normalised eligibility schedules in your environment for interrogation by your optimisation tool, utilising your preferred integration format.

Streamlined Collateral Asset Data Access

- Provide end-users with access to asset-level data, including haircuts, while integrating with Core-Collateral’s Long Box and mobilisation engine for efficient management of counterparty availability and movement windows.

Seamless Integration Options for Eligible Collateral Management

Baton’s cloud-native Eligibility Service has been designed to be interoperable, modular and extensible – so it can be deployed to support your business in the way you need it to.

Available as Part of Baton’s Core-Collateral Platform

The Eligibility Service seamlessly integrates with our Core-Collateral solution, providing users access to advanced collateral management features, including the Baton Longbox for consolidated asset data, optimisation to improve portfolio efficiency, and asset mobilisation capabilities for the efficient execution of movement instructions.

Discover Baton’s Core-Collateral solution: Fill out the form here to access our product information sheet.

Or Integrate with Proprietary or Third-Party Workflows

Do you already have workflows in other business areas where this service would prove beneficial? No problem.

Extensive integration capabilities lie at the core of our modular Eligibility Service, enabling clients to seamlessly embed the service into existing operations and both proprietary and third-party workflows in an interoperable manner for enhanced efficiency and collaboration via our advanced API.

Our Eligibility Service is just one of the modules available as part of our Baton CORE® platform.

Make Smarter Collateral Management Decisions

Optimise efficiencies, mitigate risk exposure, and enhance your decision-making with Baton’s Eligibility Service.

Request your demo today and take the first step toward effortless, real-time collateral management.

Intraday Liquidity Management

Real-Time Intraday Liquidity Management

Reduce funding costs, release trapped liquidity, and drive scalable growth with Baton’s

next-generation intraday liquidity management solution.

Stop Leaving Liquidity on the Table

Legacy systems restrict visibility, slow reactions, and immobilise capital. Without real-time insight and robust controls, banks face elevated liquidity buffers – inflating costs and constraining growth.

Baton’s Real-Time Intraday Liquidity Management Solution provides the visibility, foresight, and automated control institutions need to:

- Reduce daily funding requirements and stabilise intraday cash positions

- Minimise peak net outflows and lower liquidity buffer ratios (LCR)

- Redeploy capital into new intraday or short-term, yield-generating opportunities

Enhancing financial resiliency and opening up new opportunities, Baton transforms intraday liquidity management into a strategic lever for improved profitability and capital efficiency.

Optimise Intraday Liquidity with

Real-Time Precision

Baton connects fragmented data, payments, and processes across the entire institution – giving treasury teams real-time control over cash, exposures, and obligations.

Key capabilities:

- Enterprise-wide liquidity monitoring and alerts across balances, payments, and counterparties

- Precision forecasting to anticipate funding needs and reduce net peak outflows

- Automated payment sequencing and prioritisation to stabilise cash flows and prevent intraday liquidity shortfalls

- Safe, transparent settlement orchestration ensuring obligations are met efficiently and traceably

Outcome: Liquidity becomes a dynamic, optimised resource – cutting funding costs, improving resilience, and driving measurable capital efficiency.

See how our real-time liquidity solution supports your treasury team

The Benefits of Baton’s Intraday Liquidity Management Solution

Real-Time, Enterprise-Wide Intraday Liquidity Monitoring

Gain a single source of truth for liquidity with live visibility of balances, exposures, credit facilities, and obligations across currencies, entities and counterparties – all in one platform:

- Real-time monitoring of balances, payments, and collateral positions

- End-of-day projections and throughput tracking

- Instant alerts for limit breaches or abnormal counterparty behaviour

- Time-stamped historic transaction traceability for faster investigations

Benefit: Enables data-driven, real-time liquidity decisions – reducing reliance on intraday credit and eliminating systemic overfunding.

Precision Liquidity

Forecasting

Predict when and where liquidity will be needed with precision.

Baton’s predictive analytics use real-time and historical data, payment patterns, and behavioural payment analytics to accurately anticipate inbound payment timings, and determine when and where, long and short balances will likely arise – and for how long.

Benefit: Treasuries can reduce volatility in net outflows, lower LCR buffer requirements, more profitably redeploy available assets and plan funding more efficiently.

Netting, Smart Payment

Sequencing & Settlement Orchestration

Access automated, programmable controls to manage outflows in real time with:

- Dynamic payment sequencing to prioritise time-sensitive obligations and stabilise cash flows

- Automated netting and payment splitting across asset classes

- Safe and transparent settlement orchestration ensuring controlled execution based on time, priority and fund availability

Benefit: Intelligent orchestration smooths payment flows, reduces peak outflows, and minimises liquidity strain and intraday funding costs.

Historical Insights

& Traceability

Every transaction is timestamped, auditable, and traceable.

Baton’s deep analytics provide insight into how and when liquidity is consumed by counterparty, business line, or market event:

- Drill down to analyse liquidity drivers and payment lineage

- Access data-driven insights to predict cash ladders

- Identify client behavioural trends affecting intraday liquidity during stress

Benefit: Leverage historical data to uncover forward-looking liquidity insights – improving forecasting accuracy, enabling proactive funding strategies, and strengthening resilience.

Counterparty & Business-Line Liquidity Analysis

Understand how liquidity is consumed and generated across your organisation.

Baton’s analytics reveal how counterparties and business lines influence overall liquidity use.:

- Analysing time-stamped liquidity profiles by customer, entity, or business line

- Assessing how individual counterparties affect available liquidity

- Identifying cross-entity inefficiencies and dependencies

Benefit: Deeper insight enables more accurate liquidity allocation, better pricing, and stronger internal decision-making.

Stress Testing &

Scenario Modelling

Model and prepare for liquidity pressures with scenario-based simulations:

- Simulate market-wide, operational, and counterparty-specific stress scenarios

- Assess liquidity throughput and buffer adequacy across currencies and entities. Model the performance of propsoed new payment strategies using your own data

- Use this insight to test and refine contingency plans against supervisory expectations

Benefit: Treasuries can demonstrate robust liquidity resilience and maintain confidence in volatile markets.

Discover More about Baton’s Modular Monitoring Tools for Intraday Liquidity Management

Delivering Measurable Impact

With the capabilities provided by Baton’s liquidity management software, institutions can take proactive steps to:

-

Reduce daily funding requirements and costs

-

Lower LCR-driven liquidity buffers by reducing net peak outflows

-

Redeploy liquidity into higher-yielding opportunities across trading and repo

-

Strengthen oversight, governance and compliance

-

Future-proof liquidity operations for 24/7 digital asset and tokenised markets

Baton turns liquidity management from a reactive process into a proactive performance discipline – enabling measurable gains in capital efficiency, profitability, and resilience.

Master Intraday Liquidity Risk

Learn how Baton’s modular solution helps banks meet ECB intraday liquidity management sound practices and strengthen financial stability. Gain practical insight into how a single, integrated platform enables dynamic control and precision management of intraday liquidity risks.

Learn About the Technology Behind our Modular Liquidity Management Solutions

New White Paper

EBA’s 2025 SREP Guidelines Propose Higher Intraday Liquidity Standards

Discover How to Optimise Liquidity and Drive Growth

See how Baton’s modular real-time intraday liquidity management software could help your institution reduce funding costs and future-proof liquidity operations.

Latest Insights

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Mitigating Post-Trade Risk

Transform Your Firm’s Ability to Proactively Mitigate Post-trade Risk

Would your firm’s counterparty, payment, liquidity and operational risk management controls withstand regulatory scrutiny?

As risk managers grapple regulatory and internal pressures to more effectively manage and mitigate post-trade risk in a changing environment, the only constant appears to be the perpetual restrictions generated by their legacy and siloed systems and processes.

Designed to liberate banks from legacy constraints, Core-Payments enables risk managers to achieve their nirvana and effectively and proactively identify, assess and mitigate risk with complete real-time visibility and control.

Read on to explore the configurable no/low code rules and robust controls risk managers can automatically instigate to mitigate risk across all payment flows and business lines.

Robust Controls Across All Payment Flows and Business Lines to Mitigate Post-Trade Risk

Core-Payment’s configurable no/low code rules and robust controls empower risk managers to mitigate risk across all payment flows and business lines, with the ability to:

- Create low-code risk controls powered by real-time, aggregated, payment data and analysis

- Orchestrate the automated, controlled and safe release of settlements on a firm-wide basis

- Control the release of payments across all channels with configurable and auditable no-code hold and release payment controls

- Automatically adjust risk management strategies and controls in real-time in response to intraday developments

- Stress counterparty and liquidity conditions quickly in order to understand your firm’s resiliency based on the realistic factors that could have a material business impact. These are rules and controls available through Core-Payments

Introducing Baton’s no-code payment hold and release rules – just one of the ways Core-Payments provide risk managers with effective payment controls

Core-Payment's Risk Controls in Action:

Mitigate Counterparty Risk

Safely settle transactions on a payment on payment (PoP) basis, ensuring counterparty payments are only released once their obligation has been fulfilled. With Core-Payments you can orchestrate the controlled and safe settlement of all transactions using smart and automated workflows, powered by real-time payment intelligence and governed by the low-code rules and conditional controls you specify.

Mitigate Payment Risk

Manage wholesale payment risk at scale with Core-Payment’s no-code hold and release rules. Strengthening operational resilience across the entire payments process, our no-code rules enable risk managers to immediately stop and control the release of all required payments and settlements. These highly configurable, automated and robust no-code hold and release payment controls can be quickly created and instantly implemented across all business areas and payment flows.

Mitigate Operational Risk

Replace manual processes with automated and simplified payment and settlement processes across client and business silos powered by collaborative, automated workflows. Using real-time data generated by the continuous reconciliation of settlements, operations managers are alerted in real-time to pending and realised settlement breaks. Via their real-time dashboard they can then access the information needed to more quickly resolve operational bottlenecks and fails.

Blog Post: Mitigating Counterparty Risk: Harness the Power of Real-time Reconciliations

Blog Post: Transform Your Firm’s Ability to Mitigate Payment Risk With On-Demand Rules

How Core-Payments Mitigates Post-Trade Operational Risks, Elevates Efficiency, and Reduces Costs

Learn How Core-Payments Enables Banks to Identify, Assess, and Mitigate Risks Effectively

Post-Trade Risk Reduction with Core-Payments®

Post-Trade Risk Reduction with Core-Payments®

Proactively mitigate post-trade risk with real-time visibility and an advanced level of control across the entire operational lifecycle, wholesale payments process and all business silos.

Discover how Baton’s tools support ECB compliance

Post-Trade Risk Reduction Challenges

Reducing post trade risks – including payment, operational, liquidity and counterparty risks – challenges many banks. Siloed systems, delayed batch-generated data, and escalation and operational processes requiring manual intervention, mean teams lack critical real-time visibility into payment and settlement flows, or access to automated firm-wide risk controls. These limitations leave firms vulnerable to inefficiencies, operational errors, and potential disruptions.

Core-Payments enables banks to overcome these constraints providing access to real-time and historical payment intelligence, actionable analytics, and automated, conditional, controls. Delivering the real-time oversight and control required for post trade risk reduction, Core-Payments empowers firms to more effectively process safe and optimised payments and settlements across all business areas.

Delivering Post Trade Risk Oversight and Control

Core-Payments is designed to transform post trade risk management, enabling banks to tackle key operational, counterparty and liquidity risks while streamlining processes, maintaining business agility and efficiencies.

Why Core-Payments?

- Complete Visibility – Consolidate data from across business silos into real-time, intuitive dashboards.

- Proactive Post Trade Risk Mitigation – Leverage data-driven predictive analytics to detect issues and automate swift responses.

- Enhanced Payment Risk Control – Instantly activate firm-wide payment hold and release rules across all required payments and settlements.

Intelligent, Modular Post Trade Risk Management Solutions

Identify Post Trade Risks

- Set up low-code alerts, configured to your business requirements to monitor critical thresholds in real-time.

- Access intuitive real-time dashboards consolidating fragmented data into actionable insights.

Accurately Assess Post Trade Risks

- Analyse time-stamped historical and real-time data, exposing patterns and risks.

- Use advanced stress testing capabilities and precision forecasting to anticipate potential impacts.

- Assess financial resilience and enable more informed data-driven decision-making.

Effective Post Trade Risk Mitigation

- Automate the controlled and conditional release of cash settlements with payment-on-payment (PoP) capabilities.

- Implement real-time no-code payment hold and controlled release rules.

- Automatically adjust risk management strategies in real-time in response to intraday market developments.

Click play to discover Baton’s no-code payment risk controls: Immediately stop and manage the controlled release of designated payments across all channels

Post Trade Risk Reduction: The Benefits of Core-Payments

Elevate your firm’s post trade risk mitigation strategies with a modular, cloud-based platform designed to scale and adapt to meet future business needs and an evolving settlements environment:

Counterparty Risk Reduction

- Conduct real-time payment reconciliations and assign cash flows against specific obligations and counterparties.

- Assess counterparty exposure in real-time.

- Safely settle on a payment-on-payment (PoP) basis with automated, conditional controls so payments are only released once obligations are met.

Liquidity Oversight and Resilience

- Monitor intraday liquidity with real-time low-code alerts to quickly identify and escalate issues.

- View real-time funding balances, available liquidity and exposures.

- Forecast intraday demands and automatically adjust payment sequencing to avoid shortfalls.

- Stress test liquidity by currency or counterparty to enhance financial resilience.

Operational Risk Reduction

- Replace manual processes with collaborative, automated workflows.

- Be alerted in real-time to pending and realised settlement breaks.

- Identify operational bottlenecks and fails across business silos with Core-Payment’s real-time dashboard.

Enhanced Payment Supervision

- Activate configurable alerts for real-time payment monitoring.

- View consolidated data sourced from multiple systems in real-time, related to counterparty and liquidity exposures.

- Implement our standardised workflows for handling exceptions, which include an auditable approval process.

Increase Capacity without Adding Risk

- Automate manual processes to enforce core policies without the need for exceptional approvals.

- Expand market footprint by deploying automated safe-settlement via (PoP).

Build a More Resilient Post Trade Process Today

Core-Payments transforms your firm’s ability to adapt and thrive in an evolving settlements landscape. Whether it’s reducing counterparty exposure, optimising liquidity, or achieving operational excellence, Core-Payments helps your business to stay steps ahead of potential post trade risks while driving business efficiency.

Make informed data-drive decisions, act with confidence, and achieve more reliable post trade outcomes with Core-Payments, the gold standard solution for post trade risk reduction.

Ready to experience the future of post trade risk management?

Insights

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Optimising Post-trade Operations

Optimising Post-trade Operations

Discover how Core-Payments® could help your firm to enhance risk management and control across the entire post-trade operations process, empower your business to scale and introduce a new level of efficiency with automated, configurable workflows powered by real-time payment data.

Automate and Increase Netting to Drive Post-Trade Efficiencies

Systematically Mitigate Post-trade Operations Risks, Elevate Efficiency and Reduce Operations Costs

Outdated and costly post-trade payment and settlement processes, often requiring manual intervention, generate significant challenges for post-trade operations. With limited oversight, a lack of real-time payment information and siloed payment controls, operations managers often struggle to proactively and systematically mitigate emerging operational risks, drive efficiency programs and effectively reduce operational costs.

Designed to enable post-trade operations to overcome these limitations, Core-Payments:

- Automates operationally intensive processes – powering configurable workflows with real-time data to reduce operational risk, increase capacity, generate efficiencies and cost reductions.

- Provides complete oversight across the end-to-end payment and settlement process and access to real-time payments intelligence.

- Equips firms to proactively reduce payment risk with the ability to instantly implement consistent firm-wide payment controls.

- Empowers users to automate safe-settlement via payment on payment (PoP) mechanisms with the ability to configure and control the release of payment instructions.

Core-Payments: Bringing structure, consistency, control and auditability to the post-trade operational management of payment functions.

Real-time Payment Reconciliations • Automated Configurable Netting • Automated Pre-Settlement Affirmations • Automated Settlement Splitting • Real-time Payment Insight • Firm-Wide Payment Hold and Release Controls

Core-Payments Benefits for Operations Managers

Learn more about the benefits that Core-Payments offers Operations Managers below.

Enhance Supervision and Risk Management with Real-time Alerts and Dashboards

Continuously reconciling payments as they’re sent and received, users are alerted in real-time to developing situations and can access configurable dashboards detailing settlement obligations, exposures and operational data. This allows fails to be quickly identified, and exceptions managed with greater oversight and increased control via an auditable process.

Build Scalable More Productive Post-trade Operations and Increase Capacity

Standardise and streamline time-consuming manual processes with automated, collaborative workflows powered by real-time data, configurable rules and controls – processes including real-time payment reconciliations, netting, pre-settlement affirmation, settlement splitting and orchestrated, controlled payment on payment (PoP) settlement.

Reduce High Intensity Manual Workloads in Times of Market Stress

Providing instant access to the real-time status of all payments and the ability to immediately instigate firm-wide payment control rules, operational teams can easily instigate remedial actions without the high volume of manual work typically activated today in times of market stress. With Baton’s no-code rules, users can quickly identify and manage the controlled release of outbound payments and all required approvals.

Reduce Post-trade Operational Risk and Costs

Automate and simplify payment and settlement processes across client and business silos to reduce errors and associated costs with Baton’s collaborative and automated workflows. Benefit from real-time alerts and reports warning of pending and realised settlement breaks. Enable the controlled retirement of expensive legacy technologies.

Improve Client Satisfaction and Expand Counterparty Coverage

Introduce flexible and automated post-trade processes that more effectively meet client requirements. Expand counterparty coverage by deploying automated safe-settlement via PoP. Enrich client relationships with online tools and incorporate processes to support new products and processes faster. Identify and resolve client issues with easy access to post-trade data and the real-time status of payments.

Enable Liquidity Savings

Build the operational infrastructure to enable liquidity managers to access real-time and historic time-stamped payment data and orchestrate the controlled release of payment instructions based liquidity management strategies such as releasing payments at a specific time, by priority order or when a dependency is met, such as fund availability.

Learn More About How Core-Payments Supports Post-trade Operations

Latest Insights

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Payment Risk Management

Real-time Payment Risk Management

Manage payment risk and settlement failures with the robust and automated stop and release payment controls provided by Core-Payments’®

Manage Payment Risk and Reduce Settlement Failures

Market participants and policy makers are increasingly focused on managing wholesale payment risk. In times of market volatility or when a counterparty becomes a concern, just one erroneous payment could result in existential risk.

However, managing payment process risk mitigation on a firm-wide basis can prove technically challenging and operationally intensive. Payments are generated by diverse business areas and across various flows governed by siloed applications controlled at the business level.

Enabling banks to manage payment risk at scale and reduce settlement risk, Core-Payment’s no-code hold and release rules introduce a new level of control. Strengthening operational resilience across the entire payments process, our no-code rules can be configured to immediately stop all required payments from being executed across all business areas and flows.

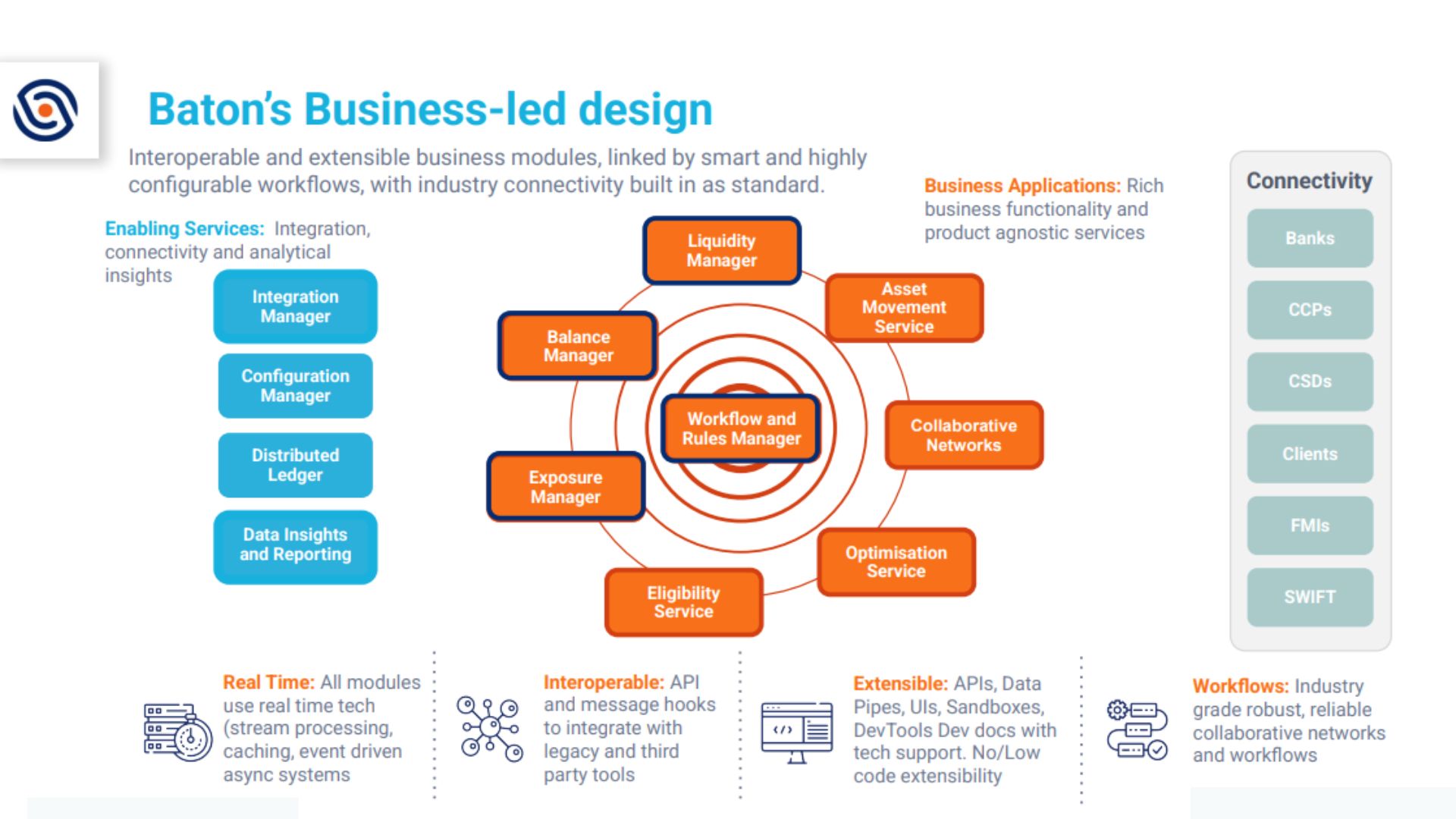

Core-Payment’s no-code rules provide yet another example of how Baton Core’s interoperable and extensible business-led design enables banks to put in place smart and highly configurable workflows and effective controls.

Payment Risk Management with Baton’s No-Code Rules

The Benefits

Reduce Settlement Failures with Robust Payment Controls

Core-Payment’s no-code hold rules can be quickly and easily created or modified. Configurable at a counterparty, currency, value and date level these rules enable users to immediately stop all payments and settlements that meet the required criteria, from being executed across all business lines and payment flows.

Informed and Controlled Payment Release

Mitigate the risk of unsettled financial obligations through proactive monitoring and control measures. Reconciling inbound and outbound payments in real-time, with Core-Payments users can understand in real-time if a counterparty has met their obligations. With this insight, users can manage the safe and structured release of payments and settlements using configurable rules.

Improve Operational Resilience with Controlled Payment Release

Develop transactional risk control strategies to maintain the integrity and reliability of financial operations. Our no-code rules can be configured to manage the release of held payments and settlements, and the levels of approval required by personnel. Users also have access to data providing full visibility of queued and released payments.

Systematically Manage Payment Risk at Scale with Automation

Core-Payment’s no-code rules allow firms to put in place robust payment controls in a systematic, automated and scalable manner. Eliminating the bursts of high intensity, manual processes that are typically activated today in times of market stress – no-code hold rules can be instantly and automatically applied in a consistent manner across all business areas and payment flows.

Quickly Create Configurable Rules without Technical Support

Core-Payment’s hold and release rules don’t require code changes. These payment risk management controls can be quickly and easily created by business users via the Baton Core-Payment UI without the need for technical support.

Access the Full Audit Trail of Released Payments

Once payments have been released, users can access a full audit trail of the approvals granted authorising these actions.

Access more resources: Payment Risk Management

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Life @BatonSystems

Life @BatonSystems

Interested in finding out what it's like working at Baton? Please find below just some of the activities and events that our amazing team members have participated in over recent months.

Sibos 2025, Frankfurt - Oct 25

The Baton team — Arjun Jayaram, Alex Knight, Ronn Baker, and Ross Dilworth — had a fantastic and highly productive time at Sibos 2025 in the beautiful city of Frankfurt.

A major highlight was Arjun Jayaram taking the stage for a compelling panel discussion alongside Gesa Johannsen (BNY), Rhomaios Ram (Fnality), and Guido Stroemer (HQLAᵡ). The group discussed how the US Genius and Clarity Acts are acting as a catalyst for institutional digital asset adoption, and the significant impact AI and intraday markets are starting to have on liquidity management.

The team met many interesting people and made excellent connections throughout the event!

Arjun Jayaram with the UK Team - Sept 25

The Baton London team had an absolutely fantastic time with CEO Arjun Jayaram in town—it was a truly memorable get-together that supercharged team spirit!

Arjun Jayaram Meets the Baton India Team - July 25

A truly inspiring time for the Baton India team!

We were thrilled to host our Founder & CEO, Arjun Jayaram, in Chennai.

Over a memorable dinner, the team not only showcased the incredible progress made on current initiatives but also set the stage for ambitious future plans. It was a powerful reminder that continuous innovation, when focused on addressing real-world problems at scale, can have such a huge impact.

BAFT Global Annual Meeting, Washington, D.C. - May 25

Great to be at the BAFT Global Annual Meeting! Ronn Baker from the Baton Systems team was on the ground, connecting with leaders in global transaction banking. These conversations are vital as we work together to reshape the future of trade, payments, and liquidity management.

FIA Boca 50, Boca Raton - Mar 25

Baton Systems was strongly represented at FIA Boca 50 by Ronn Baker and Tucker Dona. They engaged with global industry leaders, effectively showcasing how our intelligent, automated, and real-time solutions are actively transforming collateral and intraday liquidity management within the derivatives industry.

BAFT International Trade and Payments Conference, Washington D.C. - Feb 25

Ronn Baker had a great time in Washington D.C. at the BAFT International Trade and Payments Conference! While it was cold and icy outside, the conversations at the conference were not as it was insightful, forward-looking, and full of energy.

Baton's UK Team Holiday Party - Dec 24

Festive fun for Baton’s London team at their holiday party! A night filled with laughter, camaraderie, and holiday cheer as the team came together to celebrate the season in style.

Ronn Baker Attends FELABAN 2024 - Dec 24

Ronn Baker attended the FELABAN Annual Assembly in Asunción, Paraguay. The event proved to be an incredible opportunity to connect with influential industry leaders and engage in discussions shaping the future of banking and payments across Latin America.

Arjun Jayaram with the Baton India Team - Sept 24

The Baton India team enjoyed an employee day out filled with inspiring moments and team-building activities. Our CEO, Arjun Jayaram shared insights and acknowledged the team’s hard work, setting a positive tone that was further echoed by Sonia Bathija and Ananth Ramakrishnan. The day featured games, team performances, and a relaxing lunch, all topped off with a breathtaking sunset that left everyone feeling united and recharged.

SIFMA Ops, San Diego - Sept 24

We’re excited to attend the SIFMA Ops 2024 event in San Diego, with our team members Ronn Baker and Arjun Jayaram representing Baton Systems. The event has put operations in the spotlight, highlighting how firms are adopting automation, innovation, and technology to streamline processes and drive strategic advantages.

Onam Celebration at Chennai Office - Sept 24

We had a wonderful time celebrating Onam at our Chennai office! The day was filled with laughter, team spirit, and festive joy, as we enjoyed beautiful traditional decorations and fun activities. Thanks to Sonia Bathija and Ananth Ramakrishnan for their support in making the celebration special!

PostTrade 360° Nordic, Stockholm - Sept 24

We were thrilled to attend the PostTrade 360° Nordic event in Stockholm. Arjun Jayaram and Alex Knight from our team were there, and Arjun also participated in the panel discussion, ‘The Tools Out There to Nail the Settlements.’ The panel covered important topics like standardisation, moving away from legacy tech, ISO 20022, matching, netting, and more—key elements in shaping trade lifecycles and settlements.

FX Market’s e-FX Awards, London - July 24

We are delighted to have participated in this year’s FX Markets e-FX Awards, where the FX PvP settlement orchestration service powered by OSTTRA and Baton Systems was recognised as the Best Settlement Initiative. Our Director of Business Development and Client Success, Ragu Raymond, attended the event and received the award alongside OSTTRA.

FIA BOCA, BOCA Raton - Mar 24

We were excited to attend FIA BOCA in Boca Raton again this year, our Founder and CEO, Arjun Jayaram, along with Head of Business Development and Client Success, Tucker Dona, and Senior Director of North American Sales, Ronn Baker, represented the company and discussed how Baton Systems helps firms automate and optimise collateral management.

International Women's Day Celebration - Mar 24

On International Women’s Day, we celebrated the amazing women who contribute to Baton’s success daily with events in our India office.

Baton's UK Team Holiday Party - Dec 23

Baton’s UK team came together to celebrate the holiday party, creating a joyful atmosphere filled with laughter, camaraderie, and the spirit of the holidays.

The Digital Dollar Project, Washington - Nov 23

We were delighted to attend the Digital Dollar Project’s event in Washington this year. Our team members, Ronn Baker, and Ravindra Madduri attended and led a fireside chat, discussing how Baton Systems’ suite of DLT-based solutions enable wholesale market participants to safely expedite the movement of assets and securities.

The Full FX, London - Nov 23

We were delighted to attend The Full FX event in London this year. Our Head of Sales and EMEA, Alex Knight, participated as a panelist in a discussion on ‘Delivering Solutions to T+1,’ moderated by Colin Lambert. They explored the challenges and solutions of T+1 settlement.

AFME’s OPTIC, Brussels - Oct 23

We were thrilled to attend AFME’s OPTIC in Brussels this year. Our team members, Alex Knight and Alistair Griffiths, attended and exhibited at this event. It provided a great opportunity to catch up with existing clients and meet new contacts across the industry.

FIA EXPO & The FullFX Events, Chicago - Oct 23

We were excited to attend both the FIA EXPO and The FullFX events in Chicago. Our Founder and CEO, Arjun Jayaram, along with the Baton Team, participated in the events. Arjun was a panelist in a discussion on ‘The Real FX Revolution – Behind the Trade’ at The FullFX event. These events provided us with valuable opportunities to connect with our clients and prospects.

SIBOS, Toronto - Sept 23

We are delighted to have attended SIBOS 2023 this year. Our Senior Director of North American Sales, Ronn Baker, represented Baton Systems at this prestigious industry event. With his wealth of knowledge and expertise in the industry, Ronn actively engaged with industry professionals, networked, and explored opportunities for collaboration.

Mohammad Abidi, Tucker Dona & Ravindra Madduri visit Baton's India office - June 23

ISLA Conference, Lisbon - June 23

The Euroclear Collateral Conference, Brussels - May 23

We are thrilled to have the opportunity to participate in the annual Euroclear Collateral Conference held in Brussels. Our Head of Sales and EMEA, Alex Knight, along with our Director of EMEA Sales, Alistair Griffiths, represented our company at this event. It was a great opportunity to connect with leading industry representatives from the broader collateral world and to benefit from a series of the very interesting and informative presentations and informal discussions.

Fintech Americas - May 23

We were very excited to participate in this year’s Fintech Americas conference in Miami. Our Senior Director of North American Sales, Ronn Baker, represented our company at the event. Ronn witnessed the remarkable innovation shaping a significant part of the world and had the pleasure of meeting many new prospects. The atmosphere was electric, and the influential leaders present showcased their remarkable impact on the region.

FX Markets Asia, Singapore - Apr 23

We are delighted to have participated in this year’s FX Markets Asia conference in Singapore, where our President – Jerome Kemp, Head of Sales and EMEA – Alex Knight and Program Manager – Akila Ramadoss, represented our company. It is with great pride that we announce our success in being awarded the “Best FX Settlement and Risk Mitigation Solution” award. Moreover, we were thrilled to be invited to speak on three panels throughout the event, reaffirming our commitment to sharing our expertise and insights with fellow professionals. We look forward to continuing to push boundaries and deliver innovative solutions to our clients.

FIA BOCA, BOCA Raton - Mar 23

We were excited to attend FIA BOCA in Boca Raton this year, where our Founder and CEO – Arjun Jayaram, President – Jerome Kemp, Head of Sales and EMEA – Alex Knight, Head of Business Development and Client Success – Tucker Dona, and Senior Director of North American Sales – Ronn Baker were all in attendance. In addition to exhibiting at this significant event for the derivatives industry, we had the opportunity to reconnect with current clients and make new connections across the field. Jerome Kemp also took part in a panel discussion on “The Market of the Future.”

International Women's Day Celebration - Mar 23

On International Women’s Day, we celebrate the amazing women who are the backbone of Baton Systems. We are proud of our highly talented and motivated team, who are driving significant impact in our company. Our women employees are integral to the success of Baton Systems, whether in software engineering, product management, operations, or HR. We extend our appreciation and gratitude to all the women at Baton Systems for their unwavering dedication, hard work, and invaluable contributions. Your unique perspectives, expertise, and talent help us foster innovation and attain our goals.

Baton's Intern Group - Feb 23

Baton Systems is thrilled to welcome our largest intern group, consisting of talented individuals from Government Engineering College, Thrissur, Christ College of Engineering, SRM Institute of Science and Technology, Ramapuram, Anna University-MIT Campus, and Amity University Lucknow Campus. We are proud to have such a diverse and skilled group of individuals join us. Let’s give them a warm welcome to the Baton Systems family!

London Networking Drinks Event - Feb 23

In February, we hosted a successful networking event where our esteemed attendees gathered to socialise over drinks and canapés. The atmosphere was fantastic, and it was great to see everyone enjoying themselves. We would like to extend our sincere gratitude to all who attended, our entire leadership team from Baton who were in attendance and we look forward to more events like this in the future.

Chennai New Office Inauguration - Feb 23

We are thrilled to announce our recent office expansion in Chennai! Our new space is three times larger than before and was officially opened by our Sonia Bathija – Head of Operations and Ananth Ramakrishnan – Head of Engineering. The inauguration was made even more special as we welcomed new interns to the Baton family. With the move to a larger space in London earlier this year, we are excited to be back in the office and ready to enhance in-person collaboration, strengthen relationships with our employees, and start 2023 on a high note. Join us in celebrating this important milestone for Baton Systems!

Baton's Work Week & Mahabalipuram Visit in Chennai - Dec 22

In December, Baton’s Chennai team along with our Founder and CEO – Arjun Jayaram, President – Jerome Kemp, COO – David Ornstein, and Global Head of Sales – Alex Knight, visited one of the famous tourist sites in India called Mahabalipuram, a historic city and UNESCO World Heritage site famous for its shore temples and monuments. The Mahabalipuram team visit was followed by lunch and games at the “Radisson Blu” resort and a wonderful panel discussion by the leadership team. Finally, the day happily ended with a group photo session.

FIA EXPO, Chicago - Nov 22

We were thrilled to attend FIA EXPO in Chicago again this year. Our Founder and CEO – Arjun Jayaram, President – Jerome Kemp, Senior Director of North American Sales – Ronn Baker, and Head of Business Development and Client Success – Tucker Dona, attended. We also exhibited at this important global gathering for the derivatives community, which provided a great opportunity to catch-up with existing clients and meet with new contacts across the industry.

Baton's UK team expansion - Nov 22

We were delighted to welcome our new joiners, Igor Gnyp, Director of Finance, Alistair Griffiths, Director of EMEA Sales, and Narcis Dimuleasa, Marketing Manager, to the Baton family and continue our growth.

Singapore cocktail party - Nov 22

In November, our President, Jerome Kemp, and Global Head of Sales, Alex Knight, caught up with old and new industry friends in Singapore. We were delighted to co-host a great cocktail party to kick-off Singapore Fintech Festival week with Illuminate Financial, Cloudwall, Copper.co, Notabene, and Talos.

Joining BNY Mellon's Singapore fintech panel session - Nov 22

Our President, Jerome Kemp, was invited by BNY Mellon to join a panel discussion at their Singapore offices discussing financial market infrastructure and the benefits of strong collaboration between banks and the fintech community. We were thrilled to participate and join industry leaders to debate this interesting topic during Singapore Fintech Festival week.

SIBOS, Amsterdam - Oct 22

We were delighted that our Founder and CEO, Arjun Jayaram, was invited to speak at SIBOS – an event that brought together more than 10,000 participants in Amsterdam. Arjun Joined a discussion with industry leaders from Microsoft, Bain & Company, Citi, State Street and CLS Group to explore how FX should evolve in a world transforming the way it moves value. Arjun provided an interesting perspective, including explaining how T+0 settlements are not only possible, but here at Baton we have been providing Payment vs Payment (PvP) settlements on a T+0 basis for 3+ years.

Baton's college visits - Aug & Sept 22

During August and September, our recruitment team visited 3 colleges in-person and met virtually with participants at a 4th institute. We welcomed over 1,000 fresh minds to learn about Baton Systems, received applications from over 600 participants and were thrilled to offer places to 40+ fantastic applicants!

Our Founder and CEO, Arjun Jayaram, visits Baton's India office - Aug 22

After a 2 year lockdown induced break, our Founder and CEO was delighted to be back visiting our Chennai office reconnecting with existing colleagues and meeting new joiners in-person. Much fun was had by all across 4 days of valuable face-time, team building activities, food and games.

Our Chennai office reopens - May 22

Baton‘s India team celebrated the reopening of our Chennai office with a team lunch – providing an opportunity for new joiners to meet their colleagues in-person.

"The people at Baton are friendly, enthusiastic and innovative - these are some of the best people I’ve worked with."

– Ragu Raymond, Director of Business Development and Client Success, Baton Systems

Core-Liquidity

Core-Liquidity®

Transfer asset ownership, in real-time, on-demand, 24/7.

With Core-Liquidity® we’re solving the old money problems associated with controlling and tracking the movement of funds with the best in new, ledger technology. Core-Liquidity, allows asset ownership to be transferred in real time, on demand, 24/7, in a legally enforceable way. It’s programmable money on existing payment rails.

Welcome to Baton. Post-Trade. Redefined.

Minimise liquidity usage and funding costs

It’s challenging to track and balance liquidity between entities and some firms find themselves crossing large spreads on interest payments and charges when they’re actually sufficiently funded to avoid these costs.

Core-Liquidity facilitates real-time, friction-free cash movements between accounts. Providing real-time reporting and smart workflows that allow you to optimise the netting and sequencing of cash movements, so they can be matched to your firm’s binding constraints.

Core-Liquidity: Transfer asset ownership in real-time

Alex Knight, Global Head of Sales and EMEA at Baton Systems introduces and demonstrates Core-Liquidity.

Baton's Core-Liquidity is a solution based around a set of wallets that are used to share an underlying cash account with a nostro bank, allowing for real-time frictionless movements of cash.

Watch this video to learn more about Baton Core-Liquidity

THESTATISTICS

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

THE PLATFORM

Changes of ownership controlled by your configurations and instructions

The Baton ledger reflects the allocation of asset ownership across a range of sub-accounts or wallets. Changes of ownership are driven through smart workflows, according to the configuration and instructions that you determine.

They’re completely flexible- and enforced by a robust rulebook, ensuring irreversibility and enabling you to achieve settlement finality.

BENEFITS:

Improved Liquidity

See huge improvements in the use of liquidity, at the firm level, with lower funding and capital costs.

Improved Control

Gain real-time reporting and control over the movement of funds between your affiliates.

Improved Performance

Reduce the operational and third-party costs associated with internal cash transfers.

See Baton Core® in Action - Book a Demo with our team Today!

Core-Liquidityat a Glance

Further reading, reference material, white papers and industry articles.

Learn about Baton's CORE solutions for FX Settlement, Payments and Collateral Management

Core-FX®

Safely settle bilateral FX trades, when you want to - immediately and on-demand via PvP.

Core-Payments®

Gain complete, real-time visibility and orchestrated control of all wholesale payments and settlements across all business silos.

Core-Collateral®

With Core-Collateral, FCMs and CCPs can automate and optimise collateral holdings and expedite the movement of cash and securities.

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Collateral optimization and intelligent automation with Core-Collateral

Collateral Optimization and Intelligent Automation

Discover Core-Collateral®, Baton’s collateral management system, designed to help firms maximize collateral efficiency in financial markets

“With firms actively preparing for US Treasury clearing, we view the FICC link to the Baton network of clearing participants as an important enabler of collateral efficiencies.”

Brian Steele, President of Clearing and Securities Services, DTCC

“We’re delighted to help clients find increased efficiencies through improved collateral mobilization in the clearing process.”

Graham Gooden, EMEA Head of Triparty Collateral Management, J.P. Morgan

“We are pleased to have connected to Baton, working together to help clearing members increase the speed in which collateral movements settle.”

Frank Soussan, Global Head of CDS Clear at LCH SA

“Working with Baton, we will be delivering a solution at the leading edge of innovation.”

Victor O’Laughlen, Digital Business Leader at BNY Mellon

Collateral Optimization Powered by Next-Generation Collateral Management Software

Seamlessly manage and optimize collateral usage, improve financial resilience and reduce operational costs by automating collateral allocations and settlement instructions with Baton’s real-time technology.

Core-Collateral empowers financial institutions with intelligent, automated collateral management workflows, real-time alerts, configurable controls and seamless two-way venue connectivity to simplify and streamline collateral management. By providing on-demand access to real-time balance data and eligibility schedules, institutions can effectively optimize collateral allocations then efficiently instruct asset and collateral movements across multiple venues – all via a single integrated dashboard.

With Baton’s collateral management software, institutions can maximise collateral efficiency with precision and ease.

Discover how Baton’s Eligibility Service simplifies and streamlines the complex process of assessing collateral asset eligibility.

Explore the Collateral Optimization and Automation Benefits of Core-Collateral

Real-time Active Collateral Management

Automated asset tracking and margin management: Seamlessly manage posted collateral in real-time, with continuous monitoring and immediate alerts for excesses, deficits, or any changes in your collateral obligations across all connected venues – Enabling institutions to stay on top of their collateral status at all times.

Maximize Collateral Efficiency

Gain complete real-time visibility into the sources and uses of collateral across all venues, with access to up-to-date eligibility schedules, haircuts, interest rates, and collateral usage fees. Automated rules and alerts help instantly identify inefficiencies, highlighting opportunities to enhance collateral utilization across venues.

Collateral Optimization

Utilize real-time balance information to optimize the value and composition of your collateral allocations for liquidity control.

Seamless collateral management workflows and configurable rules automatically select which assets to pledge or recall, allowing you to achieve your goals faster and more cost-effectively. You can also schedule automated asset movements based on specific events or at regular cadences.

Instruct Collateral Movements Quickly and Efficiently

Effortlessly initiate bulk cash and collateral pledge or recall movements in real-time using configurable rules for maximum efficiency. All assets can be mobilized through Baton’s consolidated dashboard offering direct connectivity to CCPs, custodians, and nostro accounts. Simplifying and accelerating time-consuming tasks.

Increase Operational Efficiency and Scalability

Eliminate inefficient manual processes by introducing intelligent and scalable, automated collateral management workflows governed by configurable rules. Access aggregated, normalized data from connected venues and internal systems in a single, on-demand view. Baton’s streamlined dashboard also now provides a quick-reference summary of key collateral drivers, facilitating faster and more informed decision-making.

Improve Client Service

Gain visibility of the full spectrum of available assets and benefit from on-demand access to venue information – expanding the scope of eligible client assets that can be considered for use. Then, leverage automated rules to efficiently mobilize client collateral, enabling rapid asset recall to enhance responsiveness and service delivery.

Learn Why a Leading US Bank Selected Baton to Streamline, Accelerate and Automate their Collateral Management Processes

Prepare for U.S. Treasury Clearing with Baton’s Direct Two-Way Connectivity

Many firms will need to establish new or expanded connections with clearing houses to meet the SEC’s mandate for US Treasury Clearing, necessitating considerable operational changes and system upgrades. To support our Core-Collateral clients through this critical transition in May 2025 we announced the extension of our network to include the DTCC’s Fixed Income Clearing Corporation (FICC).

As a result, Baton’s clients can now gain improved access, increased control, and efficiency in managing their US Treasury collateral operations.

4 Ways FCMs Can Optimise Collateral Efficiency and Bolster Capacity

Watch to learn more about Core-Collateral

Automate and Expedite the Movement of Cash and Securities with Baton's Direct Two Way Connectivity to Major CCPs, Custodians and Nostro Accounts

Source: *According to Public Quantitative Disclosures (PQDs) data

Latest Announcements:

Baton Systems to Transform Collateral Management Decision-Making with New Eligibility Service

THESTATISTICS

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

84%

Pretium suspendisse sit arcu eu.

Learn How Our Core-Collateral Management Software Could Help Your Firm Automate and Optimize Collateral Management Effectively

Latest Insights

Learn about Baton's CORE solutions for Payments, Liquidity, and FX Settlement

Real-time Payment and Settlement Control

Reduce funding costs, counterparty and payment risk with real-time payment intelligence and enterprise-wide payment control

Real-time Intraday Liquidity Management

Optimise intraday liquidity use, increase financial resiliency and reduce intraday funding costs with real-time visibility, traceability and control

On-Demand FX PvP Settlement

Safely settle bilateral FX trades when you want to and extend the benefits of PvP settlement across currencies and counterparties

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly