Real-time Intraday Liquidity Management

Intraday liquidity management solutions that enable financial institutions to proactively mitigate intraday liquidity risk, reduce funding costs and optimise liquidity positions with real-time visibility and control

Optimise Intraday Liquidity Management

Banks often struggle to mitigate intraday liquidity shortfalls or fully optimise intraday liquidity use and payment flows due to outdated manual processes and siloed systems that limit real-time, enterprise-wide visibility. Real-time liquidity data often exists, but their inability to quickly aggregate and analyse it with additional insights hinder early warning detection. Challenges accurately predicting inbound payment timings and forecasting intraday demands further complicates matters, as does the lack of automated and controlled payment sequencing tools.

Baton’s modular intraday liquidity management software provides a real-time liquidity oversight and optimisation platform. Offering enterprise-wide visibility and control, institutions can monitor and manage cash positions and intraday liquidity requirements with precision, cut funding costs, assess whether intraday buffers can be reduced, and strengthen financial resilience. With Baton banks benefit from:

- Real-time, enterprise-wide, liquidity monitoring

- Granular historical insights, payment traceability and analysis capabilities

- Precision intraday liquidity demand forecasting tools

- Real-time alerts and early warning indicators

- Automated, optimised and conditional payment execution controls

- Liquidity throughput monitoring and management tools

- Extensive stress testing and scenario building capabilities

Discover how our intraday liquidity management solution could support your treasury team

Manage and Control Intraday Liquidity Risk

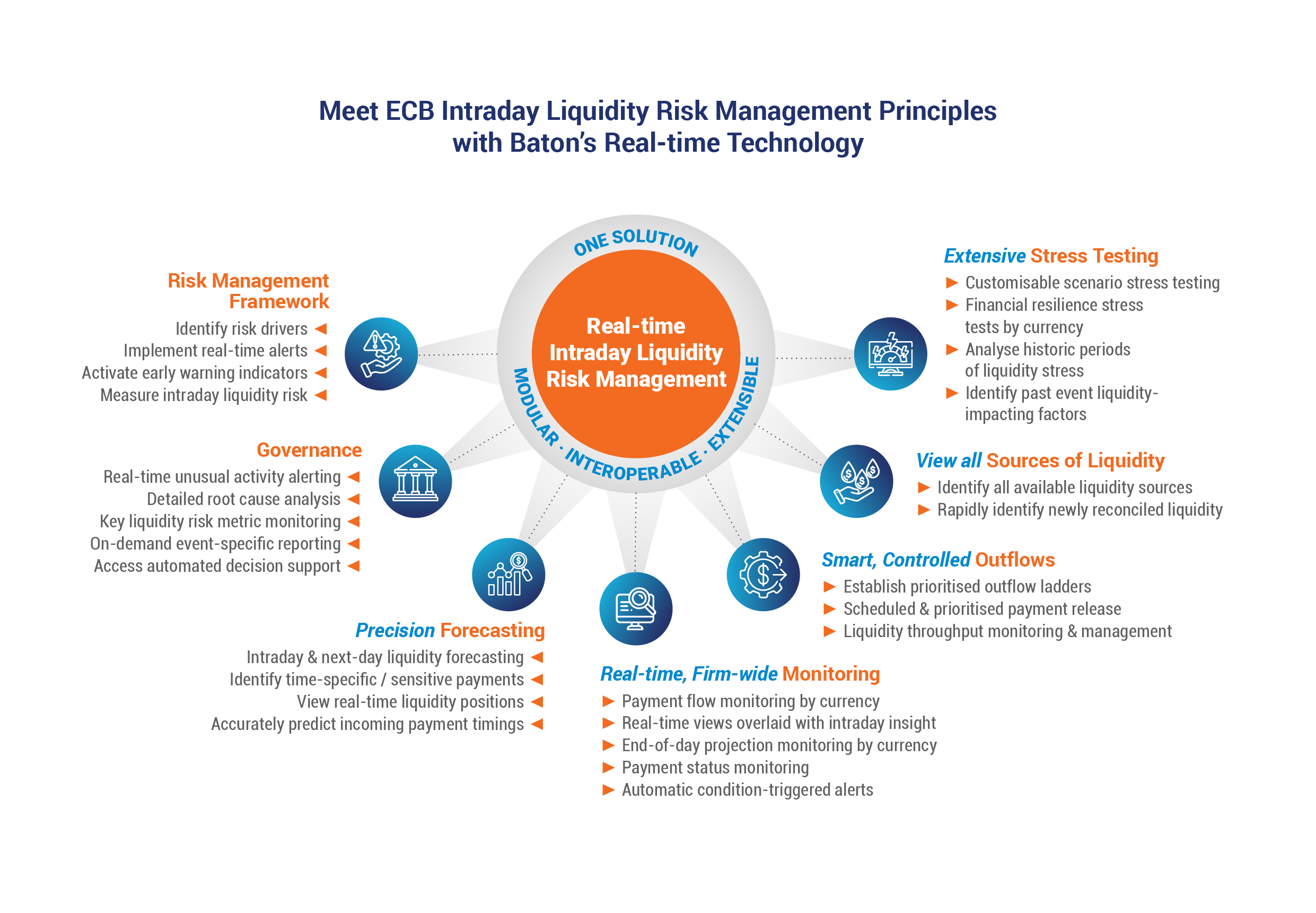

Streamline and simplify compliance with the ECB’s intraday liquidity risk management principles using Baton’s next-generation modular intraday liquidity risk software. Empowering financial institutions to accurately anticipate and plan for intraday liquidity demands, more effectively manage time specific obligations, prioritise outflows, and boost operational efficiency even in volatile conditions.

Baton enables institutions to adopt a dynamic liquidity control system to proactively address intraday liquidity challenges and maintain financial stability. With the tools and capabilities to navigate intraday liquidity risks with precision and confidence, firms can address multiple aspects of the ECB’s seven sound practices through a single, integrated platform.

Discover the Benefits: Baton’s intraday liquidity management software

Real-time, Enterprise-wide Liquidity Monitoring

Implement an automated real-time liquidity monitoring solution to ensure real-time visibility and control over financial resources. Baton provides a 360-degree real-time view of liquidity positions detailing all balances, credit facilities, exposures and obligations across the entire organisation via a single dashboard.

Proactively Manage Intraday Liquidity Demands

Leverage advanced liquidity analytics applications to gain insights into cash flow patterns, accurately forecast inbound payment timings and their projected impact on intraday liquidity. Then automatically optimise liquidity usage by intelligently sequencing outbound obligations to stabilise liquidity flows.

Take Control of Intraday Liquidity Stress

As markets change, quickly and accurately forecast how stressed conditions will impact intraday balances. Then use automatically generated smart sequencing recommendations to minimise potential shortfalls.

Smart, Automated and Controlled Payment Orchestration

Automatically orchestrate the scheduled release of payment instructions based on your required conditions – such as time, priority order, or other dependencies, such as current fund availability.

Automate Netting Calculations and Splitting Settlements

Automate netting calculations and affirmations of netted settlement amounts reducing manual intervention and enabling netting across multiple asset classes. And use smart, collaborative workflows to automatically split settlements into agreed shapes defined by the specific rules mutually agreed with your counterparties.

Analyse Counterparty and Business Line Liquidity Consumption

Using Baton’s Balance Manager, analyse time-stamped liquidity profiles across customers, legal entities, products, and funding sources to assess how, for example, individual counterparties impact liquidity availability across business lines.

Trace and Analyse Factors Impacting Intraday Liquidity

Drill down into individual liquidity flows, trace liquidity influencing factors and use data-driven insights to predict cash ladders and increase understanding of client behaviours in times of market stress.

Enhance Liquidity Stress Testing

Power extensive stress testing capabilities with real-time data and predictive analytics to evaluate and plan how intraday liquidity could be effectively stressed to increase financial resiliency in adverse conditions.

Download our Intraday Liquidity and Risk: The Hundred Million-Dollar Challenge white paper, designed to help financial institutions address the challenges faced managing intraday liquidity.

Deploy Baton’s Comprehensive Liquidity Management Software to Streamline Treasury Operations and Improve Decision-Making Processes

Watch to Learn About the Technology Behind our Modular Liquidity Management Solutions

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly