Intraday Liquidity Forecasting and Real-Time Payment Sequencing

Forecast intraday liquidity. Control settlements in real-time. Improve capital efficiency.

From Liquidity Insight to Controlled Settlement

Most banks can see their intraday liquidity position. Far fewer can confidently control settlement behaviour to actively manage and minimise intraday requirements.

Baton’s intraday liquidity forecasting and real-time payment sequencing capabilities use continuously updated projections to drive settlement decisions – enabling institutions to stabilise settlements, reduce peak liquidity pressures, lower funding requirements and improve capital efficiency as conditions change.

Deployed Modularly. Adopted Incrementally. Easily Extendable

Capital and Regulatory Impact

Intraday liquidity forecasting and sequencing directly shape capital efficiency, funding requirements and resilience. By stabilising settlement behaviour and reducing peak liquidity pressure, institutions can:

Lower intraday and contingent funding requirements

Reduce excess liquidity buffers without increasing risk

Improve return on equity (ROE) through more efficient capital deployment

Strengthen P&L resilience during periods of market stress

Demonstrate robust intraday liquidity risk management

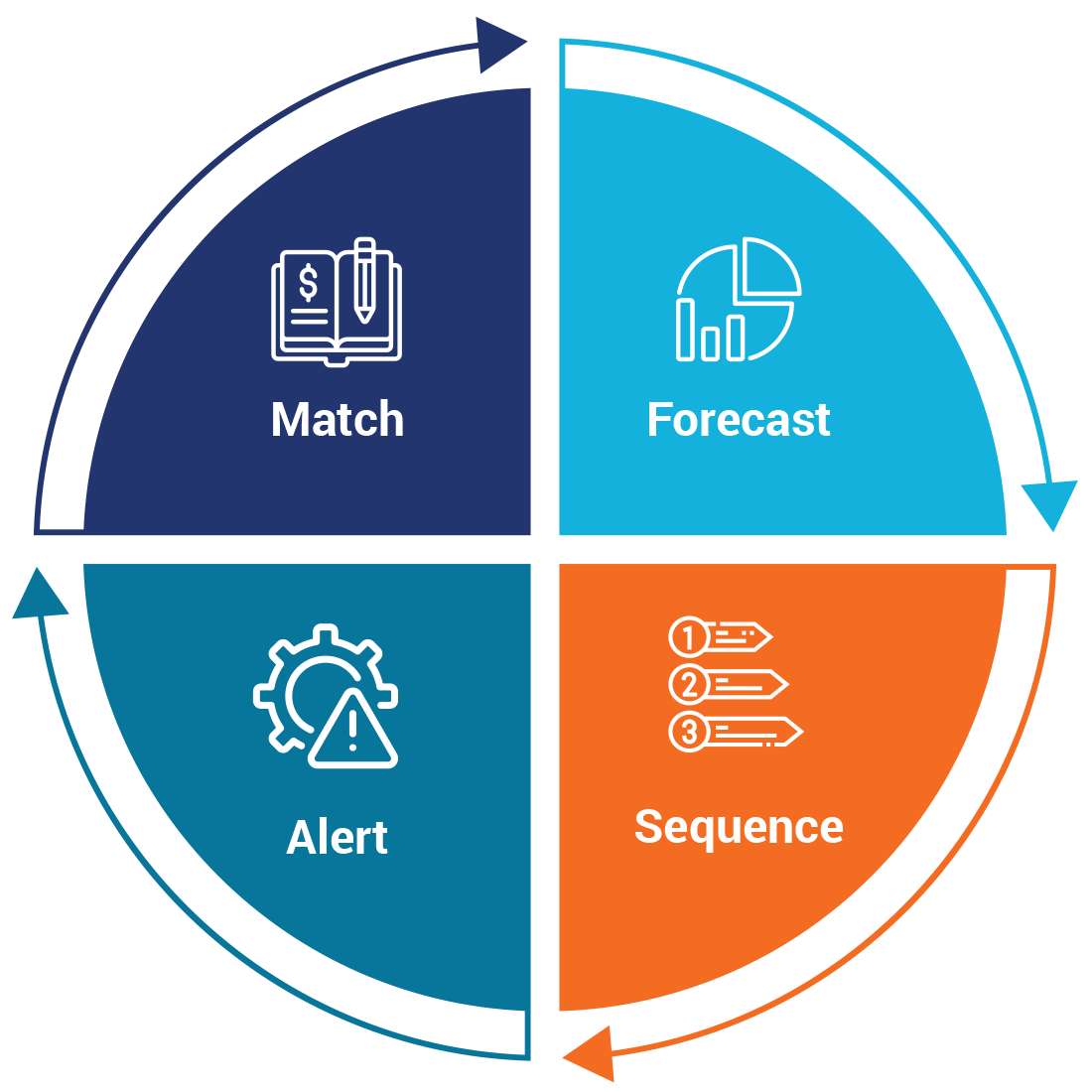

An Integrated Framework

for Real-time Liquidity Control

Baton provides the control layer that connects intraday liquidity insight to settlement execution. Institutions can deploy individual capabilities – such as real-time monitoring, payment matching, precision forecasting or smart sequencing – independently, then extend coverage as needs evolve.

Forecasting and payment sequencing modules work together to govern the conditional release of payment instructions in real-time. Decisions are based on reconciled inflows, expected positions, payment priorities and real-time constraints – optimising liquidity use across currencies and entities.

At scale, Baton operates as a real-time decision and coordination layer, linking treasury and risk systems with payment rails to connect insight directly to execution across the payment lifecycle.

With Baton, real-time liquidity decisions are continuously informed, and driven, by live execution and reconciled data:

-

- Start-of-day forecasts are calculated by combining anticipated exposures, outstanding and counterparty, and currency-specific, historic payment behaviours

- Real-time payment matching and settlement progress continuously update liquidity projections anticipating emerging funding pressures and dynamically adjusting payment sequencing

- Sequencing and throttling decisions feed back into forecasts, refining expected positions as payments are released or deferred

- Alerts and anomaly detection surface deviations from expected behaviour, allowing for the recalibration of intraday projections and sequencing decisions

Each settlement event informs the next decision, enabling liquidity to be actively managed throughout the day and stabilised under stress.

Decision-grade Foresight for Intraday Liquidity Control

Baton delivers continuous intraday liquidity forecasting, including intraday, end-of-day and next-day projections, calculated using:

- Historical counterparty settlement behaviour to predict inbound payment timings

- Scheduled obligations, including mandatory Time-Specific Obligations (TSOs) and priority payments

- Live balances, reconciled cashflows and in-flight payments

- Real-time variance tracking between expected and actual flows, and timings from forecasts

Value Delivered:

- Continuous recalibration: forecasts automatically update intraday as conditions change, providing a current view of expected liquidity outcomes

- Granular visibility: liquidity forecasts are available by currency, legal entity, counterparty, product or intraday time bucket

- Decision confidence: providing the precision needed to support confident funding, sequencing and settlement decisions under BAU and stressed conditions

Outcome: Decision-grade foresight into projected net outflows, peak liquidity usage periods and emerging funding pressure points.

The real-time data layer behind forecasting and sequencing

Baton’s monitoring tools unify live and historical liquidity data to power accurate forecasting and controlled payment execution.

Controlled Payment Release Driven by Accurate Forecasts and Real-time Data

Baton uses intraday liquidity forecasts alongside real-time balances and settlement updates to determine when and how payment instructions are released.

Payment initiation is continuously informed by:

- Expected liquidity positions and timings from forecasts

- Confirmed inflows and real-time settlement status

- Payment priorities, TSOs, cut-offs and throughput requirements

All release decisions are driven by configurable rules powering a transparent and auditable process, with human override controls.

Enabling Institutions to:

- Dynamically optimise payment sequencing as liquidity conditions evolve

- Prioritise TSOs while deferring less urgent flows

- Throttle or hold lower-priority payments when balances fall below defined thresholds

- Release payments conditionally as forecasted or confirmed inflows materialise

- Manage payment release within credit line constraints, supporting reduced intraday borrowing and funding costs

Outcome: Controlled, conditional release of settlement instructions

Aligned with the ECB’s Intraday Liquidity Risk Management Sound Practices

The ECB’s Intraday Liquidity Risk Management Sound Practices require accurate intraday forecasting and active outflow management throughout the day. Baton is designed to directly support Principle 3 (Forecasting) and Principle 5 (Managing outflows) – enabling institutions to meet supervisory expectations today, while establishing a foundation for more active liquidity and settlement optimisation over time. Baton enables institutions to:

Intraday & next-day forecasting

Forecast intraday and next-day liquidity needs using live balances, scheduled obligations, payment priorities and counterparty-specific historical settlement behaviour

Identify & protect TSOs

Identify and plan for time-sensitive payments, including mandatory TSOs and discretionary priority payments, with clear visibility into timing and funding impact

Continuously updated projections

Continuously update intraday and end-of-day projections throughout the day, tracking actual versus expected inflows, outflows and cumulative liquidity usage as conditions evolve

Detect funding stress early

Anticipate funding pressure and large known transactions early enough to take proactive funding or sequencing actions

Dynamically prioritise outflows

Actively manage outflows through prioritisation and throttling, applying clear outflow ladders, thresholds and conditional release logic to ensure TSOs are met on time in BAU and stressed conditions

Throttle & release with control

Lift or adjust throttles transparently, based on predefined liquidity conditions, throughput requirements and real-time settlement status across all material currencies

Maintain human oversight

Maintain full auditability and human oversight, with clear lineage from forecast inputs through sequencing decisions to payment execution

By combining continuous intraday liquidity forecasting with governed, rules-based payment sequencing, Baton enables institutions to demonstrate active intraday liquidity risk management in line with ECB supervisory expectations.

Designed for Institutional Environments

Baton is designed for live, regulated environments where liquidity decisions must be controlled, explainable and resilient.

Built for banks and non-banks operating at scale across multiple currencies, legal entities and settlement infrastructures, Baton enables real-time control with auditability and regulatory confidence.

Baton operates as a real-time coordination layer, linking treasury insight, risk constraints and payment execution across existing systems and rails.

Institutions retain full control over how decisions are applied. They can:

- Execute sequencing, prioritisation and throttling directly within Baton, or

- Publish priorities, flags and recommendations to upstream or downstream systems

Designed to work across existing infrastructures, Baton is interoperable and extensible, allowing decisioning and execution to be placed where it best fits without restructuring core systems.

Baton’s approach to implementation is designed to deliver value incrementally, without requiring upstream system changes or a full operating model redesign before benefits are realised.

It is cloud-native and securely deployed as an overlay, not a rip-and-replace platform. Integration follows established enterprise standards – reducing implementation effort and accelerating time-to-value.

Institutions can adopt adopt forecasting and sequencing proportionally, starting with the currencies, entities or flows where intraday risk is most material, and expand capabilities over time without having to re-work earlier integrations or deployments.

Baton is designed to support both targeted intraday liquidity controls and high-volume, multi-currency operations using the same cloud-based scalable architecture designed for resiliency and high availability. As requirements evolve, capabilities can be easily extended without disruption to existing processes or controls.

This means:

- Forecasting logic, sequencing rules and workflows can be adjustedthrough configuration, not re-engineering

- Higher transaction volumes are supported without operational rework

- New rails, data sources, payment types and workflows can be introduced incrementally

- Scaling across accounts, currencies, and legal entities does not require re-architecture

- Regulatory and policy changes can be reflected quickly and safely

This allows institutions to address immediate intraday liquidity risks with a scalable and resilient platform, able to support business growth and evolving supervisory expectations.