Continued under-investment in post-trade solutions, combined with the siloed nature of payment systems and disparate operating processes means that financial institutions often rely on manual processes and outdated legacy technology to implement workflow rules. These constraints stifle innovation, perpetuate post-trade inefficiencies, limit transparency and significantly hinder firms struggling with payment system risk – the risk of erroneously sending an outgoing payment.

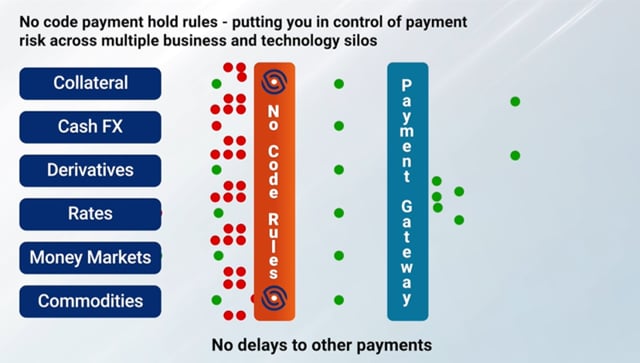

However, it doesn’t have to be this way. The ability to create or modify no-code rules in real-time, using interoperable technology that liberates users from legacy constraints, allows risk, liquidity or operations teams to rapidly respond to evolving situations and centrally control the universe of payments being processed by all systems across the bank. Yes, that’s right – rules that control all payments being executed across all business areas and payment flows simultaneously. Aaron Ayusa, Baton Systems’ Director of Client Success, explains how Baton’s agile approach based on the rapid creation of no-code rules can help firms effectively supervise their business flows in line with their firm’s governance model and introduce controls that:

- Accelerate the firm’s ability to respond to and mitigate payment system risk

- Create optimised workflows and

- Deliver automated end-to-end processing.

Rules or preferences are used by firms to provide guidance and standardisation to workflows in the various life cycles of a cash flow. They might include risk management controls such as limits on settlement sizes by product, market or counterparty, requiring additional approvals, the need for supporting documentation, or credit checks.

Post-trade processes at financial institutions have typically evolved over the years by adding pieces of technology as demand arises. This often results in a very complex situation with dozens of systems generating payment needs spread over a myriad of different business units. These siloed and disparate applications are often unable to support coordinated workflow efficiencies, meaning all too often that firms rely heavily on inconsistent, outdated, standalone, and manual processes. Inevitably, this increases the risk of making incorrect or duplicate payments, which in turn can lead to delays and additional costs, and potentially invites regulatory scrutiny.

“This can result in a very complex situation with 100+ systems generating payment needs spread over a myriad of different business units”

Where rules are automated, they are often hardcoded somewhere within an institution’s legacy platforms. Changing them is time-consuming and requires support from already overstretched technology partners as well as a material lead time. All of this conspires against a swift reaction to managing and controls risk as market or counterparty events unfold.

Surprisingly often there is also a reliance on key team members for valuable information required to implement rules, such as those needed to approve large value settlements, manage recurring missed payments or incorrect settlements. This information might be stored on multiple Excel spreadsheets or simply in the heads of the individuals based on their personal experience or relationships with counterparties. Such information isn’t always handed over on a timely basis – not only proving extremely inefficient but also risk generating.

Mitigating Payment System Risk: The implications

Payment system risk is an area that is gaining increasing regulatory focus with rule makers expressing concern that if an individual firm lacks sufficient controls over the payments it’s making, it may find itself deficient of the liquidity needed to meet its own obligations.

“Payment system risk is an area that is starting to gain increasing regulatory focus with rule makers expressing concern that if an individual firm lacks sufficient controls over the payments it’s making, it may find itself deficient of the liquidity needed to meet its own obligations”

Furthermore, it’s becoming increasingly important for firms to be able to implement or change rules quickly, and evolve their approach to mitigating risk in response to an often rapidly changing internal or external environment. Recent heightened volatility, such as in RUB during 2022, creates a need for currency-specific rules to be updated and implemented. The need can also apply on a counterparty level: to mitigate payment system risk arising from dealing with a particular firm (or all firms from a specific geography) it might be necessary to quickly add rules to control payments around thresholds, additional approvals, credit checks, or routing some cash flows differently.

Today, transparency is more important than ever to financial market participants. In order to maximise it, firms need to implement transparent and effective decision-making and also evidence its use, producing a reliable audit trail of relevant approvals within a standard system or process, rather than relying on disparate and often incomplete email chains to justify previous actions. Complexity increases for an effective audit trail in order to recognise 100s of thousands of daily payments generated over dozens of siloed systems and the need to track each payment’s state change: transaction initiated, transaction confirmed, funds received, AML/BSA, MT103 created, MT103 released, in-transit, received, etc. For example, to properly track and audit 500,000 settlements involves accurately recording 4,000,000 instances/daily!

“Complexity increases for an effective audit trail in order to recognise 100s of thousands of daily payments generated over dozens of siloed systems and track each payment’s state change”

As an aside, easy access to reliable, complete, and up-to-date information is vital for any approval process to have value. Traditionally approvers are asked to provide the required acknowledgement on the basis of offline, and often incomplete or outdated information. This is no substitute for having all of the supporting information in a single system.

Mitigating payment system risk and gaining control quickly and effectively

In today’s fast-moving market conditions, it is essential for financial institutions to respond with speed and efficiency, especially when it comes to mitigating payment system risk. Baton’s Core-Payments® solution is able to consume all payment obligations from the firm’s various disparate systems and provide users with the freedom and ability to configure robust and automated no-code payment control rules or preferences (based on the specific and often very individual requirements relevant at the time) at a counterparty, product or currency level in real-time. These might include, automated rules checking for atypical payments, for example, from a given counterparty based on their previous behaviour. The configured rules then automatically apply to all current and outstanding future cash flows, across all business lines, raising alerts if a payment triggers a relevant rule.

“Baton’s Core-Payments® solution is able to consume all payment obligations from the firm’s various disparate systems and provide users with the ability to configure rules or preferences at a counterparty, product or currency level in real time”

Not only does this liberate firms from the constraints of legacy systems and manual processes, but it also gives firms full transparency and an audit trail: users are able to determine when and by whom the rules were set up and approved and when they were triggered. Core-Payments also provides the ability to view supporting documents where needed. Documentation such as emails or confirmations from client counterparties are attached to the workflow itself. This gives approvers a one-stop shop of real-time information, making it fast and easily accessible with all required information in one place. Baton’s no-code rules are quick to set up and modify and are under the control of the users reducing the dependence on IT, saving both time and cost whilst driving business agility.

“This gives approvers a one-stop shop of real-time information, making it fast and easily accessible with all required information in one place”

Introducing Baton’s no-code payment hold and release rules – just one of the ways Core-Payments provide risk managers with effective payment controls

The need for smart and scalable solutions for mitigating payment system risk

With Core-Payments, firms are able to programme into the solution the information that might otherwise be held by a select few individuals within an organisation. This makes the solution smarter, more automated, and more scalable.

“With Core-Payments, firms are able to programme into the solution the information that might otherwise be held by a select few individuals within an organisation”

Like all of Baton’s capital market native solutions, Core-Payments has been designed to be highly interoperable with existing systems, delivering fully connected post-trade processing without the need to rip and replace whilst at the same time providing a pathway for a full technology upgrade. The solution eliminates the need to manually link multiple, disjointed post-trade systems by covering all stages of the cashflow lifecycle across multiple business or technology silos.

Baton’s use of distributed ledger technology (DLT) means that hard-coded interfaces are now a thing of the past and manual processes can be replaced with robust automated post-trade workflows, powered by real-time payments intelligence and streamlined across all products with flexibility and transparency.