Transform Your Firm’s Ability to Proactively Mitigate Post-trade Risk

Would your firm’s counterparty, payment, liquidity and operational risk management controls withstand regulatory scrutiny?

As risk managers grapple regulatory and internal pressures to more effectively manage and mitigate post-trade risk in a changing environment, the only constant appears to be the perpetual restrictions generated by their legacy and siloed systems and processes.

Designed to liberate banks from legacy constraints, Core-Payments enables risk managers to achieve their nirvana and effectively and proactively identify, assess and mitigate risk with complete real-time visibility and control.

Read on to explore the configurable no/low code rules and robust controls risk managers can automatically instigate to mitigate risk across all payment flows and business lines.

Robust Controls Across All Payment Flows and Business Lines to Mitigate Post-Trade Risk

Core-Payment’s configurable no/low code rules and robust controls empower risk managers to mitigate risk across all payment flows and business lines, with the ability to:

- Create low-code risk controls powered by real-time, aggregated, payment data and analysis

- Orchestrate the automated, controlled and safe release of settlements on a firm-wide basis

- Control the release of payments across all channels with configurable and auditable no-code hold and release payment controls

- Automatically adjust risk management strategies and controls in real-time in response to intraday developments

- Stress counterparty and liquidity conditions quickly in order to understand your firm’s resiliency based on the realistic factors that could have a material business impact. These are rules and controls available through Core-Payments

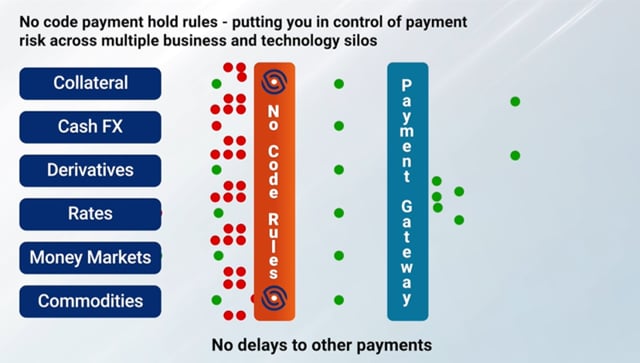

Introducing Baton’s no-code payment hold and release rules – just one of the ways Core-Payments provide risk managers with effective payment controls

Core-Payment's Risk Controls in Action:

Mitigate Counterparty Risk

Safely settle transactions on a payment on payment (PoP) basis, ensuring counterparty payments are only released once their obligation has been fulfilled. With Core-Payments you can orchestrate the controlled and safe settlement of all transactions using smart and automated workflows, powered by real-time payment intelligence and governed by the low-code rules and conditional controls you specify.

Mitigate Payment Risk

Manage wholesale payment risk at scale with Core-Payment’s no-code hold and release rules. Strengthening operational resilience across the entire payments process, our no-code rules enable risk managers to immediately stop and control the release of all required payments and settlements. These highly configurable, automated and robust no-code hold and release payment controls can be quickly created and instantly implemented across all business areas and payment flows.

Mitigate Operational Risk

Replace manual processes with automated and simplified payment and settlement processes across client and business silos powered by collaborative, automated workflows. Using real-time data generated by the continuous reconciliation of settlements, operations managers are alerted in real-time to pending and realised settlement breaks. Via their real-time dashboard they can then access the information needed to more quickly resolve operational bottlenecks and fails.

Blog Post: Mitigating Counterparty Risk: Harness the Power of Real-time Reconciliations

Blog Post: Transform Your Firm’s Ability to Mitigate Payment Risk With On-Demand Rules

How Core-Payments Mitigates Post-Trade Operational Risks, Elevates Efficiency, and Reduces Costs

Learn How Core-Payments Enables Banks to Identify, Assess, and Mitigate Risks Effectively