|WHITE PAPER

Intraday Liquidity Control: From Visibility to

Real-Time Optimisation

A practical operating model for real-time liquidity control, designed to help institutions reduce funding costs, release excessive liquidity buffers, and strengthen settlement certainty across global operations.

Most institutions can now produce real-time liquidity data – but it remains fragmented, hard to act on, and is rarely fully leveraged to materially improve outcomes.

This paper introduces a practical liquidity optimisation and control model that turns real-time information into governed intraday action, enabling firms to reduce liquidity usage, improve funding precision and deliver more predictable settlement outcomes.

Quantified Impact: What Real-time Liquidity Control Delivers

The model aims to enable institutions to benefit from reductions in:

- Liquidity usage

- Funding costs

- Excess liquidity buffers

- Exceptions

Demonstrating the potential financial and operational gains available when liquidity becomes a real-time, governed, data-driven process.

Part Three of Baton’s Real-Time Liquidity Series

This white paper builds on our earlier publications – Intraday Liquidity & Risk: The Hundred Million Dollar Challenge and Mastering Real-Time Liquidity Management.

Those papers established the foundations of visibility and insight.

This paper delivers the final step: real-time execution and control.

A Unified Model for Continuous, Real-Time Liquidity Control

Banks already operate multiple intraday liquidity controls, but these processes are distributed across systems and cannot adapt continuously as conditions change.

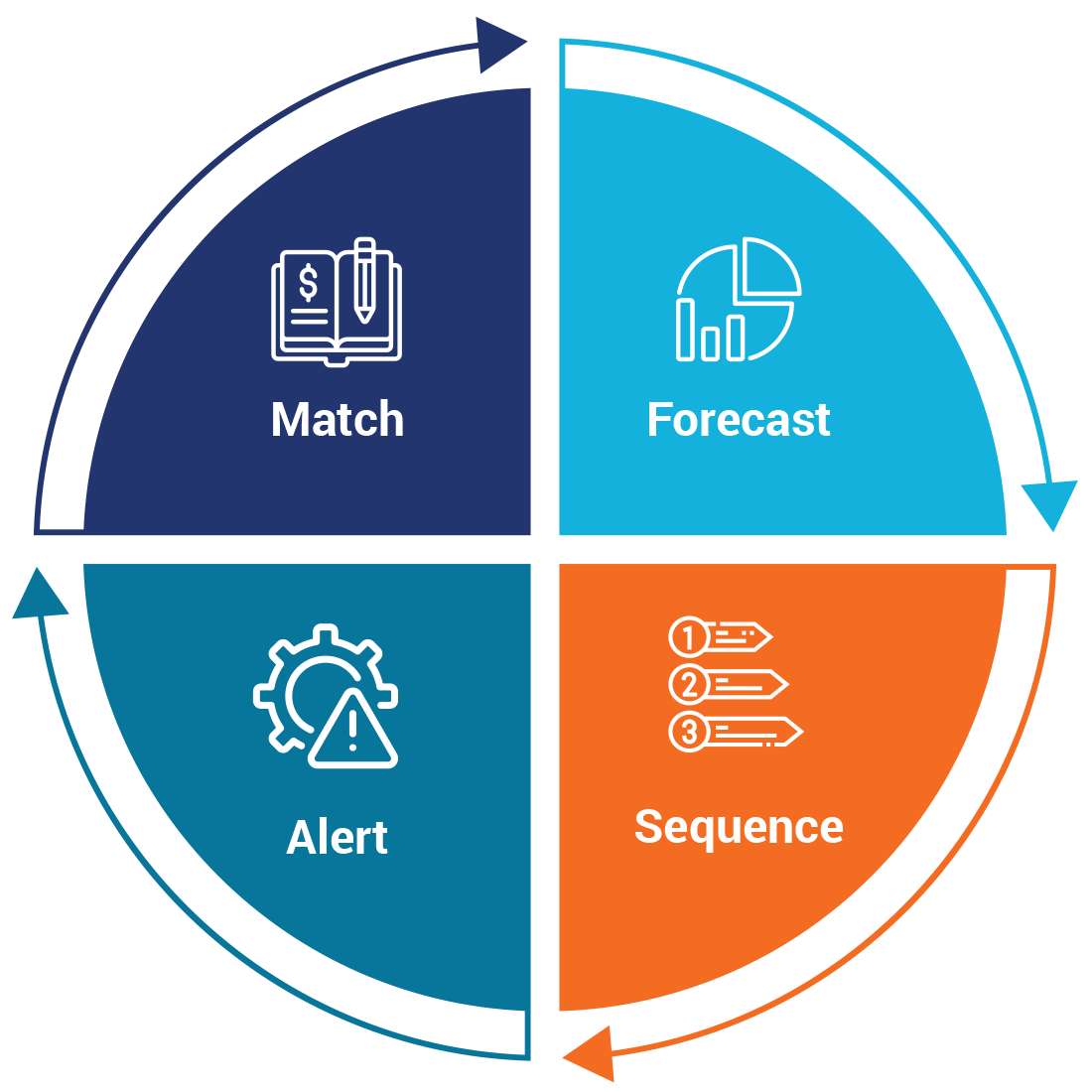

This white paper outlines how to replace this reactive posture with a single, real-time optimisation cycle that unifies:

- Real-time inbound payment matching

- Intraday balance forecasting

- Controlled payment sequencing and prioritisation

- Anomoly detection and early warning indicators

These capabilities create the continuous, self-improving control loop described in the paper, where:

- Inflows inform sequencing

- Sequencing shapes intraday credit usage and release timings

- Each decision updates forecasts

- Deviations trigger rapid recalibration

This unified model enables institutions to minimise peak net outflows, reduce funding costs and stabilise settlement behaviour across currencies and time zones – without requiring immediate core system replacement.

Why Real-time Liquidity Control is Now Essential

Settlement windows are compressing, flows are becoming more time-critical and supervisory expectations are shifting decisively toward demonstrable intraday transparency and control.

Institutions that continue to rely on manual workflows or static buffers will face rising funding costs, operational friction and reduced agility to support evolving client and trading activity.

Real-time optimisation is becoming a prerequisite for resilience, efficiency and readiness for emerging tokenised and digital asset 24/7 settlement environments.

Download the White Paper

The Real-time Liquidity Optimisation Loop

What the White Paper Delivers

A detailed, practitioner-level blueprint covering:

- Core Capabilities:

- Real-time inbound payment matching

- Intraday balance forecasting

- Governed payment sequencing and prioritisation

- Anomaly detection and early-warning indicators

- The real-time liquidity control model

- A continuous, closed-loop optimisation cycle that refines decisions throughout the day.

- Technical blueprint

- An integration-first, overlay architecture that introduces real-time optimisation without requiring immediate core system replacement, and is resilient, extensible and AI-ready.

- Governance framework

- Transparent, auditable and overrideable controls aligned with expanding supervisory expectations

- ROI and Business Impact

- Material reductions in liquidity usage, funding costs, operational effort and buffer requirements.