Build the Bank of the Future

Connected, real-time tools that unlock growth across liquidity, collateral, and payments.

FUTURE-PROOFING POST-TRADE PROCESSING ACROSS LIQUIDITY, COLLATERAL AND PAYMENTS

Legacy technology is holding institutions back - generating risk, eroding margins and blocking access to digital innovation. Today’s institutions need real-time post-trade processing that actively coordinates liquidity, collateral and payments across firms. The next generation of financial infrastructure must deliver:

Speed, Resilience & Scalability

Always-on global markets demand zero downtime.

Interoperability & Extensibility

Seamlessly connect with digital settlement venues – without disrupting existing operations.

Intelligence & AI-Readiness

Consolidate fragmented data into real-time actionable insight that drives smarter decisions.

EMPOWERING TECHNOLOGY LEADERS TO BUILD THE BANK OF THE FUTURE

Our proven, modular cloud technology provides the automated capabilities and architectural flexibility financial institutions need to address today's risk, capital, and liquidity challenges and critically offers a secure, scalable bridge to the 24/7 digital future.

Real-Time Visibility

and Control

Gain real-time visibility and traceability across complete end-to-end processes, combined with programmable, conditional execution of real-time liquidity management, collateral and payment processes and settlement tasks configured to meet your firm’s specific liquidity and risk priorities.

Programmable Settlement Orchestration

Reduce risk and increase liquidity efficiency by using collaborative workflows to automate netting processes, synchronise programmable payments, and facilitate dynamic settlement orchestration across a choice of fiat and digital settlement venues.

Real-Time Data Integration

Baton’s low-code Integration Manager reduces integration timelines by up to 90% – standardised data flows enable unified, real-time insights.

Coordinated, Real-Time Workflows

Streamline and optimise movements across institutions using smart, collaborative and real-time, end-to-end workflows. execution of liquidity, collateral and payments processes and settlement tasks configured to meet your firm’s specific liquidity and risk priorities.

Interoperable, Collaborative Networks

Digital networks, built on a proven, market-driven architecture, enable institutions to seamlessly collaborate using coordinated workflows and deliver industry-wide solutions to liquidity, collateral and payment challenges. of fiat and digital settlement venues.

AI-Ready Infrastructure

Expose MCP interfaces for integration with client LLMs, enable agent-based automation of operational workflows and agent-based tools to power new insights.

RESILIENT, SCALABLE AND EXTENSIBLE BY DESIGN

Processing almost $30Billion every day for 7 of the 9 largest global banks, Baton’s technology is engineered for mission-critical environments:

Scalable & Resilient

Cloud-based scalable infrastructure designed for resiliency and high availability.

Interoperable

Robust APIs, support for industry-standard and event-based protocols, pre-built connectors, MCP interfaces and low-code integration tools.

Secure by Design

Advanced encryption, secure access protocols and key storage management safeguard sensitive data.

Intelligent & Automated

Built-in decision support tools, STP processes and low-code configurable workflows replace manual processes with smart automation.

Modular & Extensible

Upgrade components with minimal disruption, create new workflows using low-code tools, and integrate with third-party plug-ins and ecosystems.

See Baton CORE® in Action - Book a Demo with our team Today!

DISTRIBUTED LEDGER TECHNOLOGY BRIDGING LEGACY SYSTEMS TO DIGITAL ASSETS AND INTRADAY MARKETS

At the heart of Baton’s innovation is DLT proven in production at institutional scale.

Bridge into Digital Markets

Fiat-to-digital convergence-ready platform providing integration and real-time settlement orchestration across traditional and tokenised rails.

Future-Ready

Unlock intraday revenue opportunities in repo, FX swaps, and 24/7 digital trading – with the speed, safety, transparency and efficiency required for scaled adoption.

Full Post-Trade Processing Lifecycle

Benefit from distributed workflows powering automated netting and payment splitting, dynamic payment sequencing, and conditional atomic settlements (PvP, DvP, DvD).

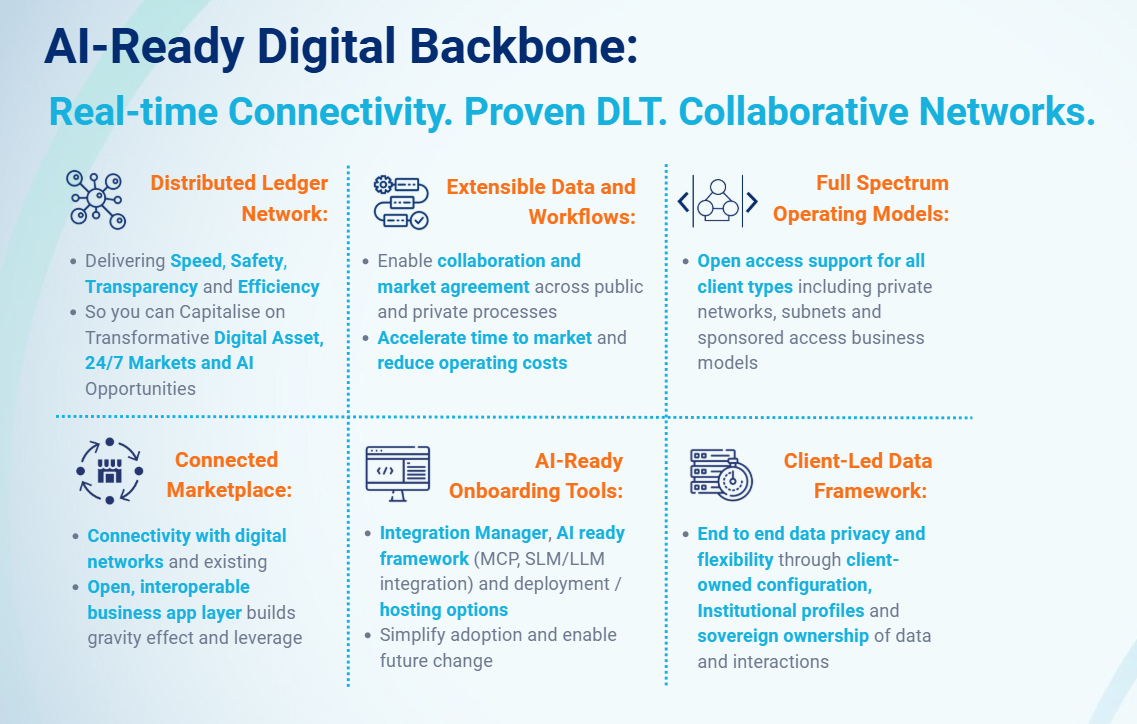

INTRODUCING BATON’S AI-READY DIGITAL BACKBONE

By connecting market participants through open architecture, with interoperable tooling and workflows, Baton provides the digital backbone necessary to collaborate and optimise the orchestration and movement of money and assets.

LEARN MORE ABOUT BATON'S TOOLS

Discover our modular and interoperable tools, engineered to deliver core functionalities.

The Integration Manager

Simplify data integration and accelerate business transformation.

The Balance Manager

Real-time visibility and control across all account balances.

The Eligibility Service

Enable smarter decisions with best-in-class data on eligible collateral

TRUSTED TECHNOLOGY. BUILT FOR TRANSFORMATION.

The world’s leading institutions choose Baton because we combine:

Deep financial expertise with proven technical strength. A culture of innovation with a track record of delivery. Independence and agility with the credibility of $13T+ settled at scale.

Trusted by the market. Built to change it..

EXPLORE BATON'S REAL-TIME SOLUTIONS

Discover real-time solutions that deliver greater control across post-trade processes, liquidity management, collateral and payments enabling market participants to unlock new revenue opportunities and manage risk on their own terms.

Don’t just react to change. Proactively capitalise on it.

Fixing Friction. Fuelling Growth.

Markets are moving fast. Baton provides interoperable, resilient and AI-ready infrastructure that supports today’s requirements and creates the pathway to seize tomorrow’s opportunities in AI, tokenised assets, and 24/7 markets.

Baton COREat a Glance

Further reading, reference material, white papers and industry articles.

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly