Optimising Post-trade Operations

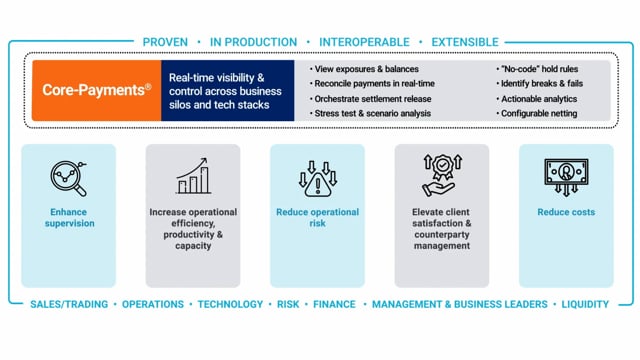

Discover how Core-Payments® could help your firm to enhance risk management and control across the entire post-trade operations process, empower your business to scale and introduce a new level of efficiency with automated, configurable workflows powered by real-time payment data.

Automate and Increase Netting to Drive Post-Trade Efficiencies

Systematically Mitigate Post-trade Operations Risks, Elevate Efficiency and Reduce Operations Costs

Outdated and costly post-trade payment and settlement processes, often requiring manual intervention, generate significant challenges for post-trade operations. With limited oversight, a lack of real-time payment information and siloed payment controls, operations managers often struggle to proactively and systematically mitigate emerging operational risks, drive efficiency programs and effectively reduce operational costs.

Designed to enable post-trade operations to overcome these limitations, Core-Payments:

- Automates operationally intensive processes – powering configurable workflows with real-time data to reduce operational risk, increase capacity, generate efficiencies and cost reductions.

- Provides complete oversight across the end-to-end payment and settlement process and access to real-time payments intelligence.

- Equips firms to proactively reduce payment risk with the ability to instantly implement consistent firm-wide payment controls.

- Empowers users to automate safe-settlement via payment on payment (PoP) mechanisms with the ability to configure and control the release of payment instructions.

Core-Payments: Bringing structure, consistency, control and auditability to the post-trade operational management of payment functions.

Real-time Payment Reconciliations • Automated Configurable Netting • Automated Pre-Settlement Affirmations • Automated Settlement Splitting • Real-time Payment Insight • Firm-Wide Payment Hold and Release Controls

Core-Payments Benefits for Operations Managers

Learn more about the benefits that Core-Payments offers Operations Managers below.

Enhance Supervision and Risk Management with Real-time Alerts and Dashboards

Continuously reconciling payments as they’re sent and received, users are alerted in real-time to developing situations and can access configurable dashboards detailing settlement obligations, exposures and operational data. This allows fails to be quickly identified, and exceptions managed with greater oversight and increased control via an auditable process.

Build Scalable More Productive Post-trade Operations and Increase Capacity

Standardise and streamline time-consuming manual processes with automated, collaborative workflows powered by real-time data, configurable rules and controls – processes including real-time payment reconciliations, netting, pre-settlement affirmation, settlement splitting and orchestrated, controlled payment on payment (PoP) settlement.

Reduce High Intensity Manual Workloads in Times of Market Stress

Providing instant access to the real-time status of all payments and the ability to immediately instigate firm-wide payment control rules, operational teams can easily instigate remedial actions without the high volume of manual work typically activated today in times of market stress. With Baton’s no-code rules, users can quickly identify and manage the controlled release of outbound payments and all required approvals.

Reduce Post-trade Operational Risk and Costs

Automate and simplify payment and settlement processes across client and business silos to reduce errors and associated costs with Baton’s collaborative and automated workflows. Benefit from real-time alerts and reports warning of pending and realised settlement breaks. Enable the controlled retirement of expensive legacy technologies.

Improve Client Satisfaction and Expand Counterparty Coverage

Introduce flexible and automated post-trade processes that more effectively meet client requirements. Expand counterparty coverage by deploying automated safe-settlement via PoP. Enrich client relationships with online tools and incorporate processes to support new products and processes faster. Identify and resolve client issues with easy access to post-trade data and the real-time status of payments.

Enable Liquidity Savings

Build the operational infrastructure to enable liquidity managers to access real-time and historic time-stamped payment data and orchestrate the controlled release of payment instructions based liquidity management strategies such as releasing payments at a specific time, by priority order or when a dependency is met, such as fund availability.

Learn More About How Core-Payments Supports Post-trade Operations

Latest Insights

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly