|WHITE PAPER

EBA’s 2025 SREP Guidelines Propose Higher Intraday Liquidity Standards

The consultation paper signals a shift towards more evidence-driven intraday liquidity resilience. This white paper explains the proposed changes, why they matter and how institutions can prepare.

Gain an Understanding of:

- What is genuinely new for intraday liquidity in the proposed SREP Guidelines

- How supervisory scrutiny of intraday liquidity may intensify

- Practical implications for liquidity, treasury and operations functions

- The operational capabilities institutions may need to develop or evidence

The European Banking Authority’s (EBA) 2025 draft SREP Guidelines propose a more operational and data-led approach to assessing intraday liquidity. While the structural framework remains intact, the draft raises expectations for what credible intraday liquidity resilience looks like in a digital, faster-moving environment.

Although the text may evolve, the supervisory direction is clear. Institutions that understand these proposals now will be better placed to anticipate supervisory expectations, identify capability gaps and prepare for more evidence-driven assessments.

Why Download this White Paper

The 2025 draft SREP Guidelines propose institutions provide more detailed, timely and operationally grounded evidence of how intraday liquidity is monitored and managed. These potential changes would have direct implications for how liquidity, treasury and operations teams organise data, analytics, processes and governance.

This paper provides a precise and practical explanation of what the EBA is proposing, what is genuinely new, and what it could mean for leaders responsible for intraday resilience.

Download the white paper to gain:

- A clear explanation of each proposed change impacting intraday liquidity

- A comparison of the 2025 draft with the 2014, 2018 and 2022 Guidelines

- Insight into how supervisory focus is shifting toward demonstrable operational capability

- Practical guidance on the data, models and intraday-capable processes institutions may require

This is not a summary. It is a decision-making tool.

The 2025 EBA SREP Guidelines: What Changes for Intraday Liquidity?

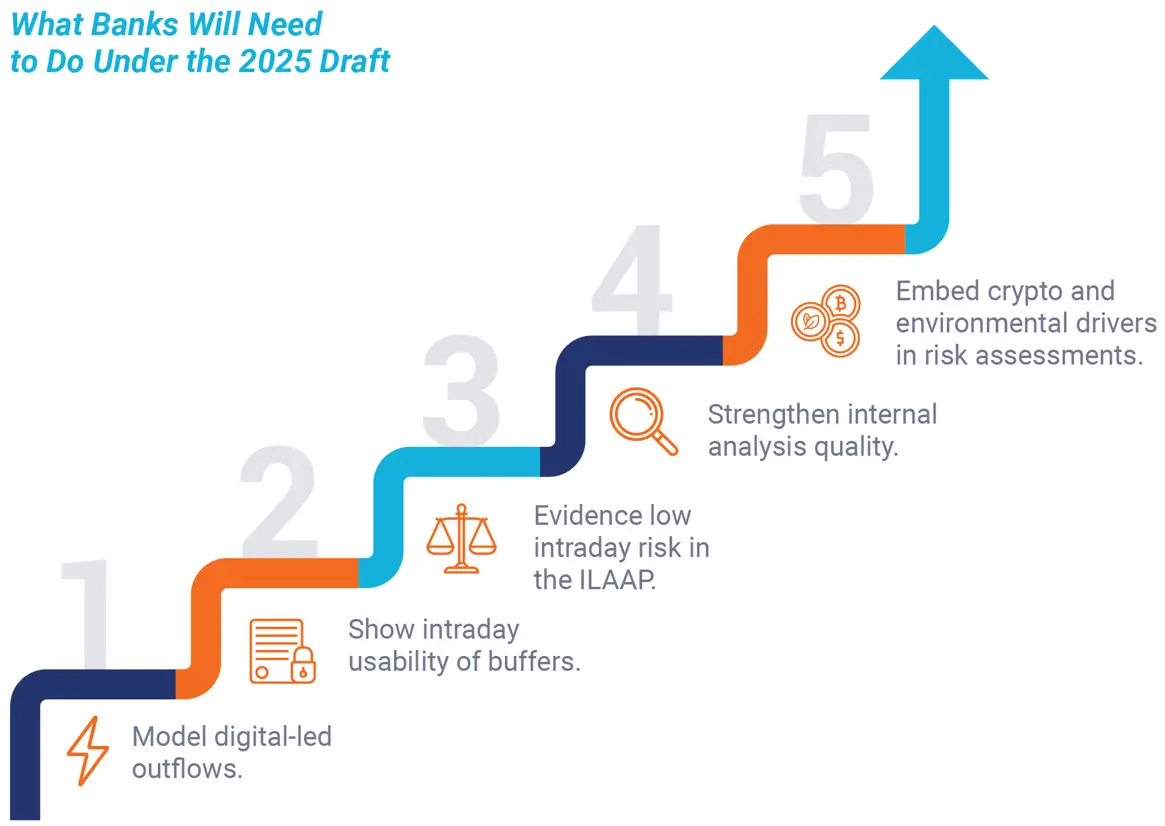

The consultation draft raises expectations in five areas:

- Faster digitally driven outflow dynamics and their impact on intraday resilience

- Intraday collateral needs affecting time-specific liquidity buffer usability

- Higher evidential thresholds for applying proportionality

- Greater supervisory discretion over the acceptability of internal intraday analysis

- Broader liquidity-risk drivers, including crypto-related and environmental channels

Together, these proposals encourage institutions to move toward more explicit, data-rich and granular evidence of how intraday liquidity risk is identified, assessed and managed.

Download the White Paper

Written for senior treasury, liquidity & operations leaders at Tier 1 & Tier 2 banks.