In November 2024, the ECB intraday liquidity risk seven sound practices were published. These principles are designed to help financial institutions mitigate the potentially cascading impact of intraday liquidity shortfalls, especially during stress situations – a risk continuing to grow in intensity and complexity.

For financial institutions, the stakes are high – recent events demonstrated the catastrophic impact that liquidity shortfalls can cause. However, for those firms that get it right, the potential benefits extend beyond intraday liquidity risk mitigation. Firms have an opportunity to enhance operational and financial resource efficiency and establish themselves as leaders in financial resilience.

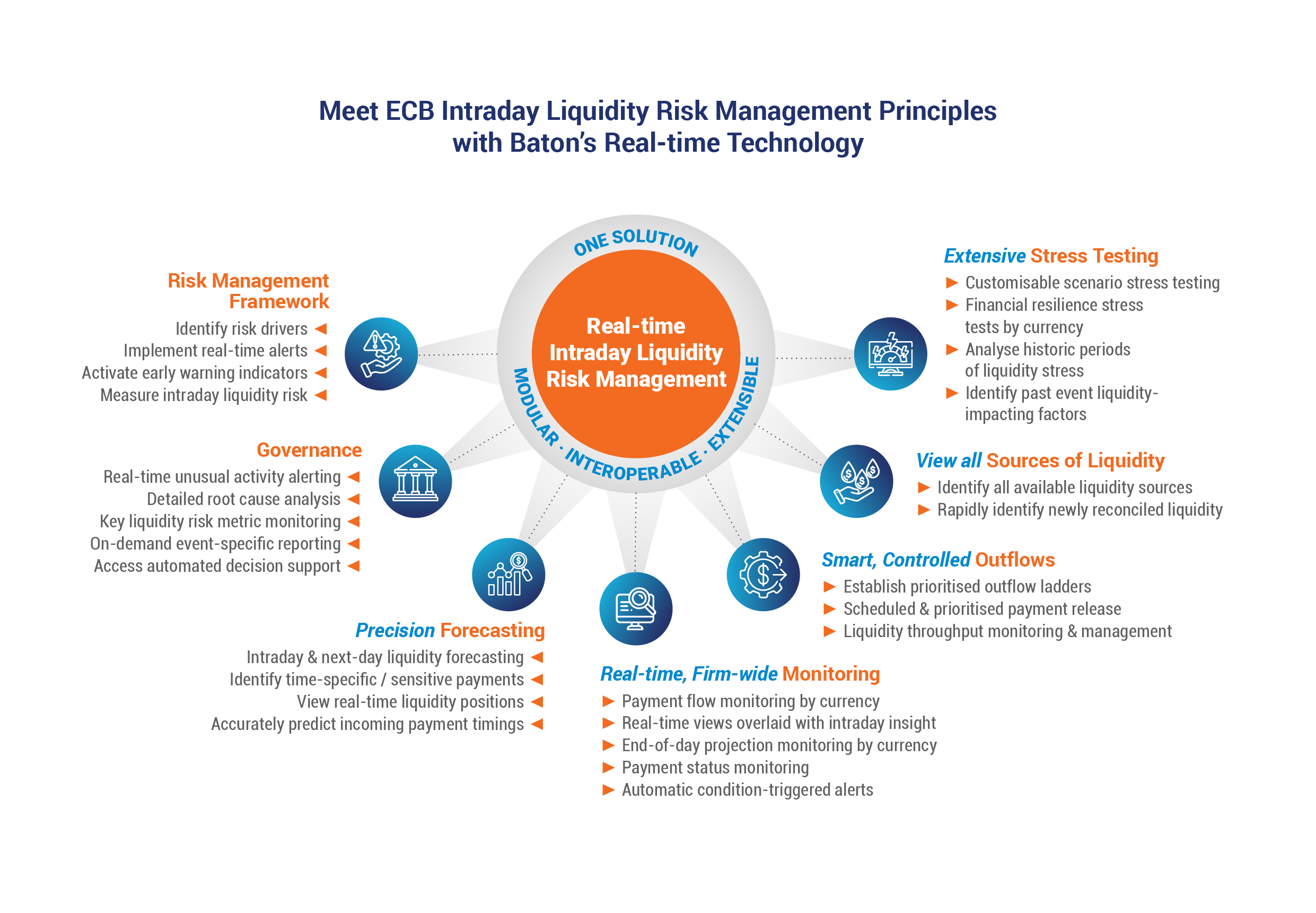

This post examines the rising importance of intraday liquidity, the core components of the ECB intraday liquidity risk management guidelines, and how Baton’s modular technology equips firms to effectively implement the tools and capabilities required to meet the ECB’s requirements with precision and ease.

“Potential benefits extend beyond intraday liquidity risk mitigation to enhanced operational and financial resource efficiencies and the opportunity for banks to establish themselves as leaders in financial resilience.”

Intraday Liquidity Risk: Why it’s is a Growing Concern

Intraday liquidity risk arises when a financial institution cannot meet its payment obligations at the required time due to insufficient liquidity. The ramifications of intraday liquidity risk and the potential for systemic risk are immense.

When a bank’s payment gets delayed, it can quickly impact counterparties, initiating a domino effect with the cascading failure of obligations throughout the financial markets. The 2023 liquidity crises several banks faced underscored just how quickly gaps in intraday liquidity can generate widespread issues. Recent years have seen multiple bouts of market turmoil – be it Covid-19, the 2022 Liability-Driven Investment (LDI) crisis or last summer’s global equities sell-off.

Managing intraday liquidity in volatile markets presents significant challenges that are further compounded by industry developments, such as the global trend towards shorter settlement cycles – reducing the time available to manage liquidity and leaving institutions with little room to manoeuvre in case of delays or the need to meet unexpected liquidity demands.

What the ECB Intraday Liquidity Risk Management Principles Aim to Achieve

As the ECB’s Nov 13th Supervision Newsletter advised, the ECB’s seven principles for managing intraday liquidity risk were published following a thematic review of intraday liquidity management practices across a sample of global systemically important banks (G-SIBs). This review revealed differing levels of maturity in the risk frameworks being operated by the banks. The new principles aim to help banks “meet intraday stress outflows”. In summary, they require financial institutions under European Banking Supervision to achieve the following objectives:

- Develop robust risk management frameworks

- Establish effective and prudent governance processes and reporting procedures

- Strengthen intraday liquidity forecasting capabilities

- Enable real-time monitoring of liquidity positions

- Manage payment outflows and prioritise payments to meet time-specific obligations

- Identify and utilise available sources of liquidity efficiently to meet intraday needs

- Conduct comprehensive stress tests to assess resilience under adverse scenarios

ECB Intraday Liquidity Risk Guidance: The Challenge for Financial Institutions

On paper, it all sounds fine. However, meeting the ECB intraday liquidity risk management guidelines for many institutions could prove far from straightforward.

Many firms continue to struggle with intraday liquidity management practices reliant on outdated manual processes and siloed systems producing fragmented data. As a result, achieving an enterprise-wide, real-time view of liquidity positions remains a significant challenge – and it’s this information that so many intraday liquidity management decisions are based on. Many also struggle to accurately predict inbound payment timings, understand how these expected timings could generate liquidity shortfalls and prioritise payment outflows in an automated and controlled manner.

“Achieving an enterprise-wide, real-time view of liquidity positions remains a significant challenge, as does accurately predicting inbound payment timings and executing automated, controlled and prioritised payment outflows.”

Baton’s Tools and Capabilities for ECB Intraday Liquidity Risk Management Compliance

We recently published a white paper, “Managing Intraday Liquidity Risk” to simplify compliance. This paper explores each of the ECB’s seven principles and how our modular intraday liquidity management technology seamlessly aligns with the requirements – providing the tools needed to meet these new standards with precision and ease. Here’s a brief summary of just some of the capabilities offered by our advanced technology:

1. Real-time, Enterprise-wide, Consolidated Liquidity Monitoring

Baton’s platform provides a 360-degree real-time view of all liquidity positions across the entire organisation via a single dashboard. Managers can easily drill down and trace the complete lineage of individual payments or exposures, instantly access the data needed to pinpoint liquidity risks, and detect unusual settlement activities and emerging risks in a timely manner. This supports swift and effective issue escalation and response.

2. Advanced Forecasting

Baton’s precision forecasting tools use historical data and advanced analytics to predict short-term, intraday, and next-day liquidity needs. Inputs include real-time liquidity data, upcoming outbound payments (considering mandatory time-specific obligations and priority payments) and uses historical trends to predict the expected timing of inbound counterparty payments accurately.

3. Scalable Governance and Alerting Tools

The technology provides real-time alerting notifying users of unusual payment activities or if a counterparty has deviated from expected or agreed behaviours – critical early warning indicators. Configurable dashboards provide role-specific insights and key intraday liquidity risk metrics; managers can also quickly generate ad hoc configurable reports and access automated decision-support tools. These capabilities allow teams to enhance both governance procedures and operational efficiencies simultaneously.

4. Intelligent, Automated and Controlled Payment Outflows

Baton’s technology provides automated, optimised and conditional payment execution controls to effectively manage the sequenced release of all payment instructions, including priority payments. This helps managers ensure that critical time-sensitive payment obligations are met while ensuring other commitments are prioritised and throughput levels are actively monitored.

5. Identify all available liquidity sources

The technology provides users with a view of all available liquidity sources across business silos. Real-time payment reconciliation capabilities enable managers to rapidly identify and redeploy recently reconciled unencumbered liquidity to manage liquidity intraday needs better.

6. Extensive Stress Testing Capabilities

Baton’s technology offers extensive intraday liquidity stress testing and scenario-building capabilities. Users can simulate worst-case scenarios, assess resilience, and use these insights to develop robust contingency plans.

The Case for Baton’s Integrated Approach

Using Baton’s next-generation technology, firms can address the ECB’s intraday liquidity risk management sound practices through one integrated platform. It’s a modular, cloud-based, interoperable solution that seamlessly integrates with the bank’s existing systems to deliver enterprise-wide improvements in intraday liquidity risk management.

As a result, using the Baton platform simplifies how institutions can achieve the ECB’s sound practices, providing a single scalable solution for improved real-time visibility, operational and risk management efficiency, and financial resilience.

Download Baton’s Managing Intraday Liquidity Risk White Paper for More Insights

Download Baton’s Managing Intraday Liquidity Risk White Paper for More Insights

Want to learn more? Download our comprehensive white paper, Managing Intraday Liquidity Risk, for a deep dive into each of the ECB’s seven sound practices and to understand how financial institutions can implement different functional modules of Baton’s intraday liquidity management technology to achieve compliance.

Seize this opportunity to enhance your institution’s approach to intraday liquidity risk. With Baton Systems, you won’t just meet regulatory requirements—you’ll set a new standard for financial resilience and operational excellence.

Access the white paper now and start your firm’s transformation toward intelligent real-time intraday liquidity management.

MORE BLOG POSTS

Financial Resiliency: Why Intraday Liquidity Risk Management Needs a Rethink

Intraday Liquidity Optimisation: A Treasury Manager’s Guide to Tooling

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly

Download Baton’s Managing Intraday Liquidity Risk White Paper for More Insights

Download Baton’s Managing Intraday Liquidity Risk White Paper for More Insights