Post-Trade Risk Reduction with Core-Payments®

Proactively mitigate post-trade risk with real-time visibility and an advanced level of control across the entire operational lifecycle, wholesale payments process and all business silos.

Discover how Baton’s tools support ECB compliance

Post-Trade Risk Reduction Challenges

Reducing post trade risks – including payment, operational, liquidity and counterparty risks – challenges many banks. Siloed systems, delayed batch-generated data, and escalation and operational processes requiring manual intervention, mean teams lack critical real-time visibility into payment and settlement flows, or access to automated firm-wide risk controls. These limitations leave firms vulnerable to inefficiencies, operational errors, and potential disruptions.

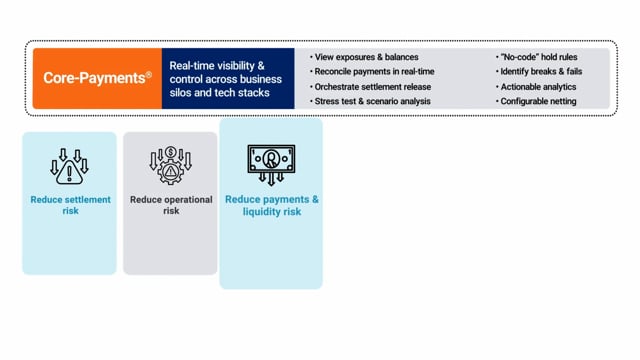

Core-Payments enables banks to overcome these constraints providing access to real-time and historical payment intelligence, actionable analytics, and automated, conditional, controls. Delivering the real-time oversight and control required for post trade risk reduction, Core-Payments empowers firms to more effectively process safe and optimised payments and settlements across all business areas.

Delivering Post Trade Risk Oversight and Control

Core-Payments is designed to transform post trade risk management, enabling banks to tackle key operational, counterparty and liquidity risks while streamlining processes, maintaining business agility and efficiencies.

Why Core-Payments?

- Complete Visibility – Consolidate data from across business silos into real-time, intuitive dashboards.

- Proactive Post Trade Risk Mitigation – Leverage data-driven predictive analytics to detect issues and automate swift responses.

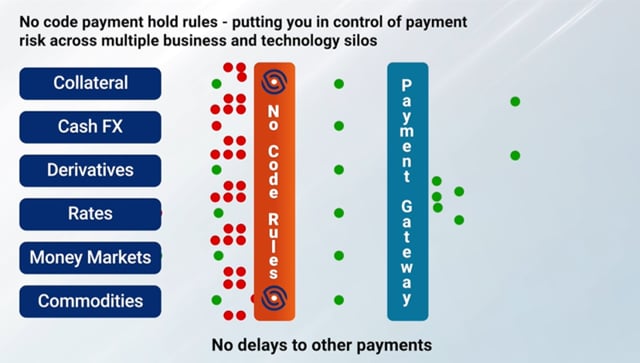

- Enhanced Payment Risk Control – Instantly activate firm-wide payment hold and release rules across all required payments and settlements.

Intelligent, Modular Post Trade Risk Management Solutions

Identify Post Trade Risks

- Set up low-code alerts, configured to your business requirements to monitor critical thresholds in real-time.

- Access intuitive real-time dashboards consolidating fragmented data into actionable insights.

Accurately Assess Post Trade Risks

- Analyse time-stamped historical and real-time data, exposing patterns and risks.

- Use advanced stress testing capabilities and precision forecasting to anticipate potential impacts.

- Assess financial resilience and enable more informed data-driven decision-making.

Effective Post Trade Risk Mitigation

- Automate the controlled and conditional release of cash settlements with payment-on-payment (PoP) capabilities.

- Implement real-time no-code payment hold and controlled release rules.

- Automatically adjust risk management strategies in real-time in response to intraday market developments.

Click play to discover Baton’s no-code payment risk controls: Immediately stop and manage the controlled release of designated payments across all channels

Post Trade Risk Reduction: The Benefits of Core-Payments

Elevate your firm’s post trade risk mitigation strategies with a modular, cloud-based platform designed to scale and adapt to meet future business needs and an evolving settlements environment:

Counterparty Risk Reduction

- Conduct real-time payment reconciliations and assign cash flows against specific obligations and counterparties.

- Assess counterparty exposure in real-time.

- Safely settle on a payment-on-payment (PoP) basis with automated, conditional controls so payments are only released once obligations are met.

Liquidity Oversight and Resilience

- Monitor intraday liquidity with real-time low-code alerts to quickly identify and escalate issues.

- View real-time funding balances, available liquidity and exposures.

- Forecast intraday demands and automatically adjust payment sequencing to avoid shortfalls.

- Stress test liquidity by currency or counterparty to enhance financial resilience.

Operational Risk Reduction

- Replace manual processes with collaborative, automated workflows.

- Be alerted in real-time to pending and realised settlement breaks.

- Identify operational bottlenecks and fails across business silos with Core-Payment’s real-time dashboard.

Enhanced Payment Supervision

- Activate configurable alerts for real-time payment monitoring.

- View consolidated data sourced from multiple systems in real-time, related to counterparty and liquidity exposures.

- Implement our standardised workflows for handling exceptions, which include an auditable approval process.

Increase Capacity without Adding Risk

- Automate manual processes to enforce core policies without the need for exceptional approvals.

- Expand market footprint by deploying automated safe-settlement via (PoP).

Build a More Resilient Post Trade Process Today

Core-Payments transforms your firm’s ability to adapt and thrive in an evolving settlements landscape. Whether it’s reducing counterparty exposure, optimising liquidity, or achieving operational excellence, Core-Payments helps your business to stay steps ahead of potential post trade risks while driving business efficiency.

Make informed data-drive decisions, act with confidence, and achieve more reliable post trade outcomes with Core-Payments, the gold standard solution for post trade risk reduction.

Ready to experience the future of post trade risk management?

Latest Insights

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly