Why netting is an important part of the FX post-trade workflow and how Baton’s technology supports the netting process by reducing the operational burden – allowing users to reduce settlement risk, reduce the number of payments they’re making and reduce costs as intraday funding can be managed more effectively.

What is netting?

“The netting of transactions allows settling parties to settle the combined value of a defined set of transactions.”

The ISDA Master Agreement serves as the contract under which OTC derivatives transactions between two counterparties take place. Payment netting is defined under the Master Agreement as taking place during the normal business of a solvent firm, and involves the combined offsetting of cashflow obligations between two parties on a given day, in a given currency, into a single net payable or receivable.

The importance of payment netting in post-trade processing

“Netting reduces settlement risk and reduces the number of payments being made, in turn this allows funding to be managed more precisely.”

The benefits of netting are threefold. Firstly and most importantly, it reduces settlement risk.

Settlement risk has been a focus of industry regulators in recent years. Principle 50 of the FX Global Code of Conduct directly references the use of automated settlement netting services as a way to improve post-trade processing and settlement risk practices.

Secondly, netting reduces the number of payments being made by the two parties to a transaction, which lessens manual processes and the possibility of error.

The third benefit, which is sometimes overlooked, is that payment netting has the impact of reducing the cash flows and funding requirements for each of the two counterparties because they are settling netted volumes rather than each underlying transaction. This means that nostro accounts can be managed more effectively and the cost of funding managed more precisely.

Why more transactions are not netted: the operational burden

Payment netting would seem to be an obvious choice for firms. But, even though I worked for one of the biggest FX businesses in the world for almost 20 years, I’m still surprised at how much flow goes through without being netted, and why. As I talk to different firms I am constantly taken aback by how much of a challenge netting appears to bring to Operations groups relying on legacy, siloed technology without the flexibility to net on a continuous or configurable basis.

“The netting process adds extra steps into the post-trade workflow: the netting itself and the agreement of netted values between counterparties.”

Although mathematically very simple, payment netting is often run in separate applications to a firm’s core deal booking systems. The agreement process between the counterparties is highly manual. It’s common for firms to use informal processes such as Excel spreadsheets and to communicate with counterparties via a range of different channels to agree settlement values. Timing can be an issue: the longer it takes for you to agree your settlement values with your counterparty, the less time you have to make the payment – and this can sometimes lead to errors being made. So pressure on the Operations and Payments teams means that often it’s simply easier not to net transactions.

Where Baton’s technology comes in: configurable netting

Baton’s technology provides customers with the ability to achieve automated configurable payment netting. Every counterparty will have their own idea of what products or currency pairs should be included and when that netting calculation should be run – for this reason we believe offering a highly configurable solution offers huge value.

“Baton’s payment netting engine, which is contained within Core-FX and Core-Payments allows our users to define, at a client and currency and currency pair level, what products and transactions to include and when to run or expose that netting calculation, so that the parties see what their netted values are.”

This runs on a continuous basis and is completely customisable, delivering choice and control.

Distributed Ledger Technology (DLT)

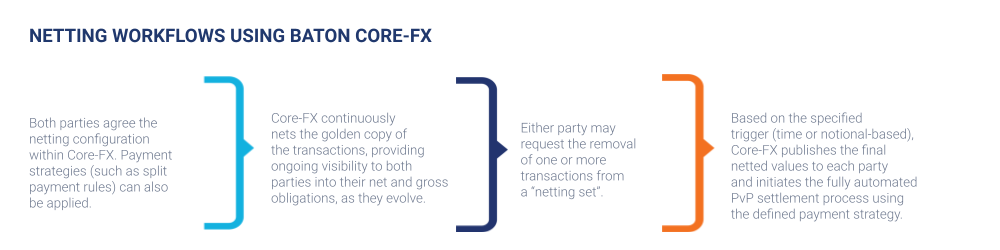

For users of Core-FX operating as nodes on the Baton interoperable distributed ledger with a distributed workflow, the netting calculation is common to both parties, so there is no need for it to be agreed subsequently. This, we feel, is the cleanest way of calculating and agreeing a netted value.

Customised Workflows

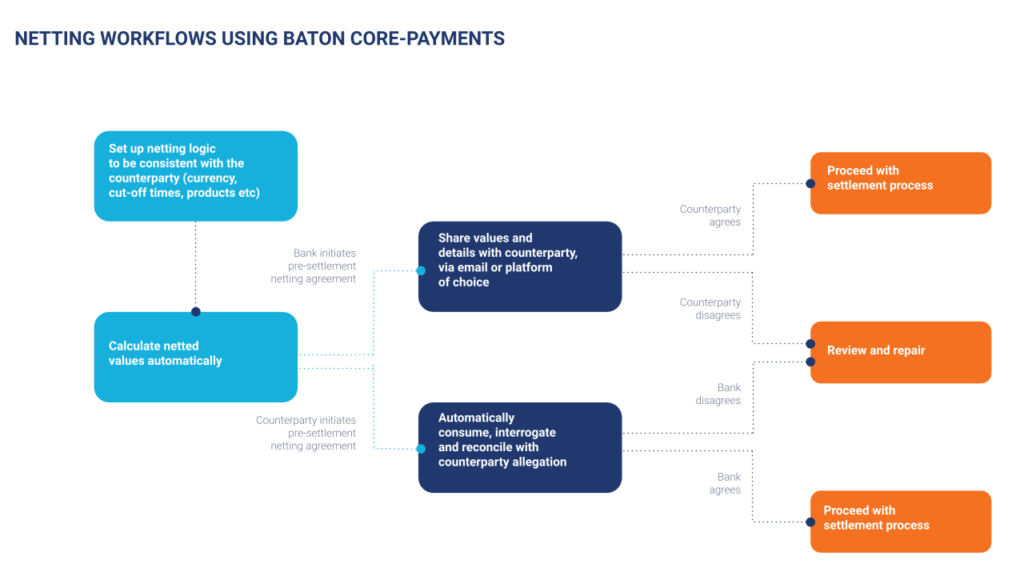

For Baton customers facing counterparties who are not nodes on a shared ledger, we can customise a workflow that will allow for an automated agreement of the values with their customers or counterparties.

The user of Core-Payments will have configured, for each of their customers, the netting calculation and process that is consistent with what they understand their customer to be operating. When that netting process has been run, Baton will initiate an automated workflow to communicate with the underlying customer for agreement of the settlement values. The workflow will send this set of calculations including the composition of the underlying transactions for approval by the counterparty, or consume from the counterparty their version of the netted calculations and cross-check that against the calculation that has been run by our customer within Core-Payments.

We record all data for our customer with the full lineage of the transaction from the final netted payment all the way up to the original trade, providing full transparency and auditability.

Transparency and Control

Transparency and Control

“The ability to run netting calculations on an ongoing basis gives control to our customers.”

Firms can easily view their gross and net obligations, not only at the counterparty level but also at an overall business level, which is hugely important with regards to planning and control.

Payment netting itself and the agreement of netted values is a very important first step in a robust settlement process. Baton then continues to bring value to our customers in the real-time monitoring and reconciliation of inbound and outbound payments and in the sequencing and orchestration of settlements, either on a PvP basis or by deploying smart workflows that operate with deference to settlement limits and other controls where our customer is not settling through PvP.

In short, by using Baton’s interoperable, shared ledger technology and customisable workflows to allow automated payment netting to take place in a manner that is consistent with the rules agreed with your counterparty, and by eliminating the need to manually calculate and agree those netted values, all trades can be netted without increasing the operational burden. This allows users to reduce settlement risk, reduce the number of payments they’re making and reduce costs by managing intraday funding more effectively.

I hope you have found this blog useful in explaining the benefits of automated netting. If you have any questions or would like to learn more about Baton Core-FX please don’t hesitate to reach out to me at [email protected].

Transparency and Control

Transparency and Control