Whether gross or net margined, the aim of Clearing Members is to optimise collateral usage at central counterparties (CCPs), reduce risk and efficiently manage liquidity. Ragu Raymond, who prior to joining Baton was an Optimisation Liquidity Manager for one of the world’s largest clearing firms, discusses the opportunities for optimisation under both gross and net collateral margining and how Baton’s collateral management technology can support the process.

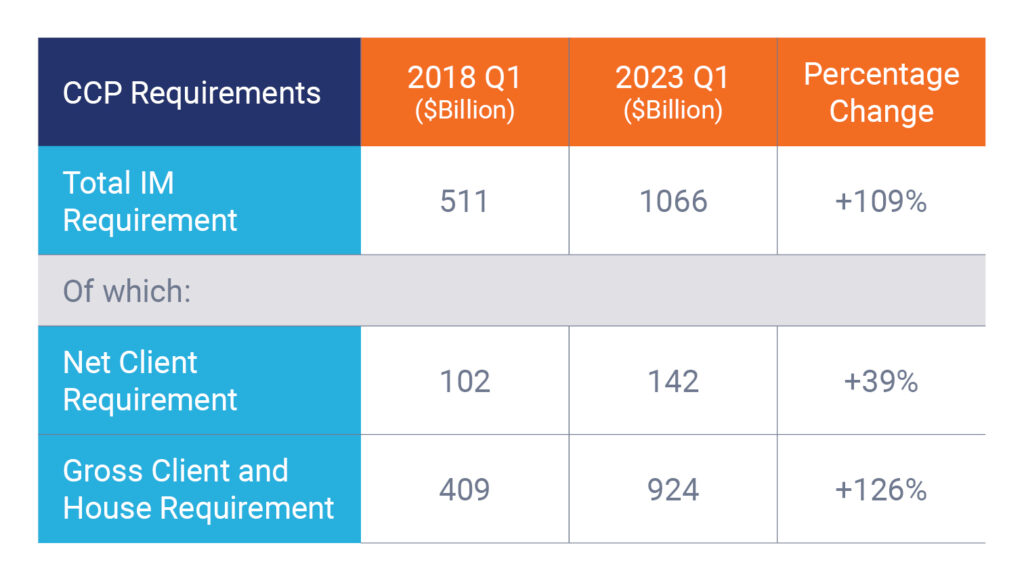

With market volatility a feature of recent years, the collateral margin requirements of CCPs have increased significantly, as shown in the table below.

“These numbers continue to rise, making collateral optimization increasingly crucial for Clearing Members, regardless of whether they are gross or net margined at CCPs.”

Gross vs. net collateral margining

CCPs collect collateral margin for customer accounts on either a gross or a net basis.

Under gross collateral margining, typically used by North American and APAC-based CCPs, Clearing Members must deliver to the CCP a margin amount equal to the sum of all the initial margin amounts that would be required for each of the underlying accounts under their membership. Net collateral margining, by contrast, is mainly used in EMEA and means that a Clearing Member’s CCP requirement includes the benefit of any offsetting risk across its portfolio of accounts. A Clearing Member with a large portfolio of client accounts can obtain a netting benefit of more than 50%, leaving a surplus available for optimisation and re-investment, subject to account structure and regulations.

The opportunities for optimisation

Gross collateral margining

If a Clearing Member is leaving an excess at a gross collateral margin CCP in order to reduce the size and frequency of overnight collateral margin calls, this will have a direct cost to the business. Firms need to ensure that all of the collateral posted to them by clients is passed on to the CCP as quickly as possible. Central to this is the requirement to have real-time visibility of balances, eligibility and obligations, along with the ability to effect collateral moves in a highly automated and efficient manner.

To select the optimal destination for the collateral, the Clearing Member needs to understand which CCP will apply the lowest haircut (greatest value). This can make a material difference, for example, a particular client could be supplying a piece of collateral that carries 10% at one CCP but attracts a 5% haircut at another. With this information at their fingertips, a Clearing Member can mix and match collateral for the best optimisation.

“Central to this is the requirement to have real-time visibility of balances, eligibility and obligations, along with the ability to effect collateral moves in a highly automated and efficient manner”

Net collateral margining

A key characteristic of net collateral margining is that the collateral received by a Clearing Member from its portfolio of clients is almost always more than sufficient to cover the CCP requirements and provide a surplus. A well-managed portfolio of collateral maximises the excess being held by the clearing member, allowing for reinvestment and increased net interest income (NII). The dramatic shift in the interest rate environment has shone a clear light on the opportunity associated with a well-managed portfolio of collateral.

One of the key inputs in the decision-making process is the eligibility list for each of the CCPs. Not only does the list of eligible collateral vary from venue to venue, but the haircut rates, interest rates, and collateral usage fees are also different. These need to be clearly understood by Clearing Members seeking to optimise their deployment of collateral usage.

Whether gross or net margined, Baton Systems’ collateral management solution – Core-Collateral™ can facilitate optimal collateral usage for Clearing Members. Core-Collateral offers users a real-time, detailed view of available and pledged assets across multiple data sources and venues. Clearing Members can track the location of all collateral in real time. Rules and alerts can be deployed to deliver additional efficiency to the decision-making processes. Meanwhile, Baton’s single point of entry for the movement of collateral to all integrated CCPs allows bulk uploads of CCP pledges and recalls to be performed. Combined with direct integration to the firm’s payments/operations platform this means that a Clearing Member is effectively unlimited in terms of the number of moves it makes, to ensure that it’s always optimised.

The normalised and aggregated eligibility data that Core-Collateral generates, automatically checks CCP collateral instructions to ensure that they will be accepted and provide good value. This eligibility check eliminates the risk of rejection from the CCP and prevents ‘waste’ collateral from clients from not being utilised, thereby eliminating delays and their associated costs to both Clearing Member and the client. Additionally, the normalised eligibility data can be consumed into a proprietary or third-party optimisation tool.

Core-Collateral is able to connect seamlessly to a Clearing Member’s internal systems as well as to a variety of triparty optimisation tools, and third-party technology platforms, allowing optimisation to take place across business lines, incorporating bilateral and tri-party collateral margins alongside CCP obligations.

“Meanwhile, Baton’s single point of entry for the movement of collateral to all integrated CCPs allows bulk uploads of CCP pledges and recalls to be performed”

I hope you have found this blog useful in explaining how Baton Core-Collateral can support both gross and net collateral margined Clearing Members in their optimisation processes.