In this post, I’ll discuss how banks can safely reduce the capital tied up in intraday liquidity buffers, a costly but necessary part of treasury management. Accurate forecasting and effective intraday liquidity management are essential, and advancements in real-time treasury technology now make it possible to reduce intraday liquidity buffers significantly, creating opportunities for banks worldwide.

During my eleven years working in post-trade operations across Singapore and New York, I closely observed treasury teams managing global liquidity needs, particularly during the overlapping settlement periods between Asia and the U.S. These experiences have shaped my understanding of the complexities of liquidity management and the management of large intraday buffers.

Funding intraday liquidity buffers costs banks hundreds of millions annually. These buffers consist of highly liquid assets set aside to mitigate the risk of liquidity shortfalls when outbound payments precede inbound funds. Furthermore, the size of a bank’s buffers depends largely on how well its treasury team can forecast and manage liquidity in real-time.

However, many banks struggle to leverage real-time data to optimise liquidity management. Even when access to this data is available, many treasury teams lack the tools to act on it quickly and effectively. This creates a gap that prevents banks from making informed, data-driven decisions fast.

How Legacy Constraints Hinder Intraday Liquidity Buffer Management

To manage intraday liquidity buffers effectively, treasury teams need a clear view of payment obligations and receivables in real-time. They must be able to predict when funds will arrive and adjust payment strategies to ensure liquidity remains stable. However, legacy systems and fragmented processes often prevent this level of oversight.

For example, many banks still reconcile payments on a VD+1 basis, meaning treasury managers make decisions based on expected rather than actual data. This uncertainty makes it difficult to confidently reduce buffer sizes.

“Many banks still reconcile payments on a VD+1 basis, meaning treasury managers make decisions based on expected rather than actual data”

How Banks Can Improve Intraday Liquidity Buffer Management

Step 1: Understand Liquidity Positions in Real-Time

To predict liquidity demands accurately, treasury teams need real-time data on current balances, exposures and obligations at the counterparty, currency, and legal entity levels.

Step 2: Accurately Predict Inbound Payment Timings

By aggregating historical data on payment timings, treasury teams can predict when inbound payments are likely to arrive, accounting for counterparty behavior, payment size, and market volatility.

Step 3: Forecast Liquidity Impact Using Predictive Analytics

Armed with the right data gained in steps 1 and 2, treasury teams can use predictive analytics to forecast how the day’s events will impact liquidity. This allows them to prepare for potential deficits and adjust their payment strategies accordingly.

Baton’s recently released real-time intraday liquidity management capabilities enable banks to achieve all of this using technology designed to interoperate with the firm’s existing systems so it doesn’t require the immediate rip and replacement of legacy. My colleague Ronn Baker wrote about Baton’s interoperable technology in this blog post recently, so if you’d like to learn more it’s worth a read.

“Baton’s real-time liquidity management capabilities uses technology designed to interoperate with existing systems so it doesn’t require the immediate rip and replacement of legacy”

Step 4: Optimise Payment Sequencing

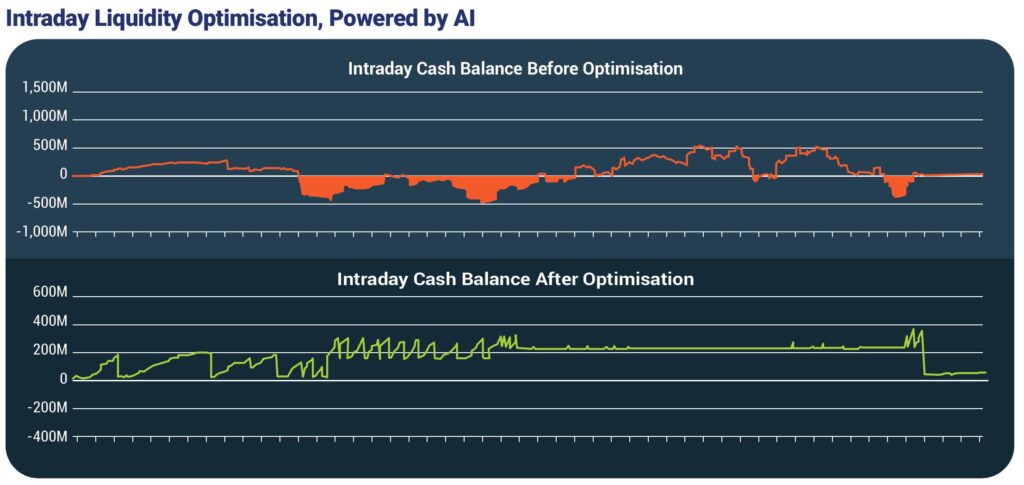

Once the treasury team understands expected liquidity flows, Baton’s technology can recommend optimal payment sequencing to avoid shortfalls. By considering payment priority and available funds, the system enables payments to be executed efficiently and cash flows to be stabilised as shown here in the image.

Step 5: Reduce Buffer Size by Clearing Critical Payments Early

Banks often face liquidity challenges when delaying high-priority payments. By clearing these payments earlier in the day, banks reduce exposure to volatility, which in turn lowers the need for large intraday buffers.

Step 6: Move to Just-in-Time Funding

Taking inspiration from the Toyota developed “just-in-time” manufacturing strategy, treasury teams can adopt just-in-time funding for liquidity. With a real-time view of obligations, teams can assess the cost of covering payments through money market trades or drawing on reserves, choosing the most cost-effective option for each scenario.

Reducing Liquidity Buffers

Accurate forecasting and real-time control over liquidity flows enable treasury teams to optimise intraday liquidity management. By leveraging the latest advancements in treasury management technology, banks can reduce costly liquidity buffers without compromising financial stability or risk management.

MORE BLOG POSTS

Intraday Liquidity Optimisation: A Treasury Manager’s Guide to Tooling

Financial Resiliency: Why Intraday Liquidity Risk Management Needs a Rethink

Why Intraday Liquidity Management Needs to be More Active and Granular

Contact our Experts

To learn more about our post-trade solutions, please provide your details and one of our experts will contact you shortly