|WHITE PAPER

Master Intraday Liquidity Risk: Implement ECB Guidelines with Confidence

Discover how your firm can comply with the ECB’s sound practices for managing intraday liquidity risk, while improving liquidity efficiencies and financial resilience

Managing Intraday Liquidity Risk with Real-time Visibility and Control

Managing intraday liquidity risk is rapidly becoming a top priority for both market participants and supervisory bodies globally. In November 2024, the European Central Bank (ECB) published a series of sound practices for managing intraday liquidity risk, however implementing the ECB’s guidelines is presenting considerable challenges for many firms.

This white paper Master Intraday Liquidity Risk: Implement ECB Guidelines with Confidence provides a practical guide for financial institutions keen to adopt modular technology-driven solutions that align with the ECB’s November 24 guidance. Furthermore, it explains how these solutions also enable firms to enhance operational and liquidity efficiencies and financial resilience.

Read our blog post “Intraday Liquidity Optimisation: A Treasury Manager’s Guide to Tooling” to learn more.

Managing Intraday Liquidity Risk: The Challenges

Intraday liquidity shortfalls present immense operational and systemic risks, demanding real-time solutions for timely decision-making. Yet, many institutions are constrained by outdated legacy processes and siloed systems generating fragmented data, leaving them unable to attain enterprise-wide, real-time liquidity visibility or accurately forecast intraday liquidity demands.

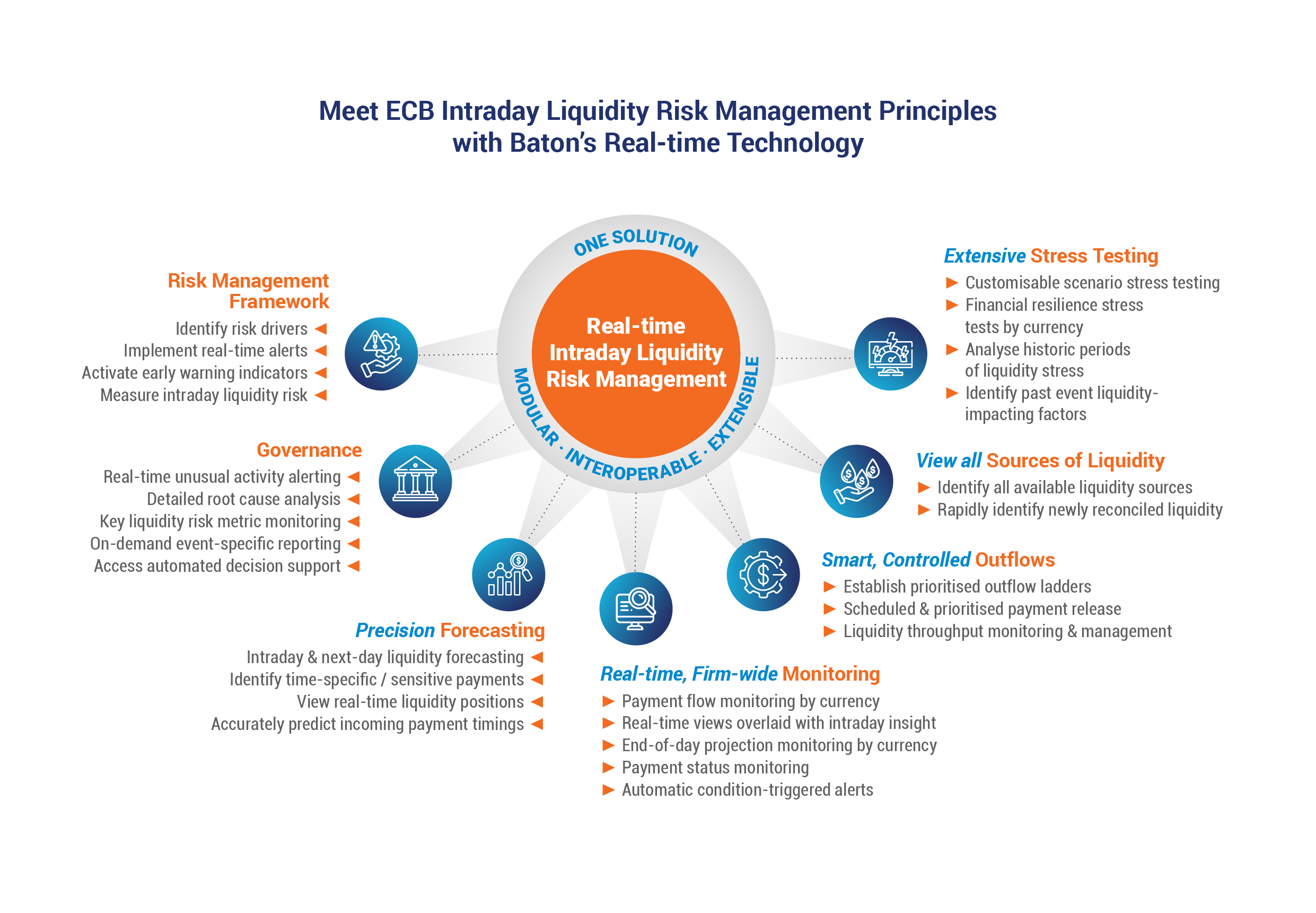

Baton’s intraday liquidity risk management software addresses these inefficiencies head-on, empowering institutions to accurately predict and plan for demands on intraday liquidity, more effectively meet payment obligations, prioritise outflows, and achieve operational efficiency even in volatile conditions.

Intraday Liquidity Tools and Capabilities Designed for Financial Institutions

The white paper explains how Baton’s platform provides the tools and capabilities institutions need to better manage intraday liquidity risk so they can benefit from:

- Real-Time, Enterprise-Wide Liquidity Visibility: Automate liquidity monitoring and gain a 360-degree consolidated, enterprise-wide view of all liquidity positions across the entire organisation via a single dashboard.

- Precision Forecasting Tools: Predict the timing of inbound payments and accurately forecast the impact on intraday liquidity demands using historical data and real-time insight.

- Intelligent, Automated and Conditional Payment Execution Controls: Prioritise and execute the sequenced release of payment outflows, to help users meet obligations on time.

- Identification of Available Liquidity Sources: Real-time payment reconciliation capabilities enable users to rapidly identify and redeploy recently reconciled unencumbered liquidity.

- Scalable Governance and Alert Mechanisms: Benefit from real-time alerting to unusual payment activities, configurable dashboards providing role-specific insights and key intraday liquidity risk metrics and access to automated decision-support tools.

- Comprehensive Stress Testing: Simulate adverse market scenarios to evaluate financial resilience and refine intraday liquidity risk management strategies.

Why Choose Baton?

Baton’s next-generation intraday liquidity risk software offers a modular and interoperable solution designed to integrate seamlessly with an institutions existing systems to deliver enterprise-wide risk management improvements. Key benefits include:

- Meet ECB Banking Supervision Expectations: Address multiple aspects of each of the ECB’s seven sound practices using a single solution.

- Proactive Liquidity Risk Management: Stay agile in unpredictable markets with real-time liquidity monitoring, alerts and early warning notifications.

- Scalable & Modular Platform: Adapt quickly to changing market conditions with a low-code, cloud-based platform.

- Enhanced Financial Resilience: Operate at the cutting edge ofintraday liquidity management to fortify your institution’s financial stability.

Take Control of Intraday Liquidity Risk Today

Adapting to the ECB’s principles doesn’t have to be complex. Baton’s cutting-edge technology simplifies the process, enabling financial institutions to not only comply but thrive. Download the white paper today to explore how Baton could help your firm prepare for a stronger, more resilient financial future.