Enable Smarter Decisions with Best-In-Class Data on Eligible Collateral

Streamline and enhance the process of evaluating collateral eligibility with Baton’s Eligibility Service, enabling accurate and informed decision-making

Eligible Collateral Evaluation: Simplified and streamlined

Collateral optimisation hinges on accurately evaluating eligible collateral, yet many institutions still rely on outdated manual processes to collect and communicate this information, increasing cost and risk. These slow and inefficient processes can fuel delayed decision-making; result in over-pledging higher-cost assets (or even mistakenly pledging ineligible collateral assets) and a reliance on pledging high-quality liquid assets (HQLAs) to mitigate the risk of lower-liquidity assets being rejected.

The impact? Missed opportunities, risk exposure and inefficient financial resource management. You now have the opportunity to rethink your firm’s approach to evaluating collateral eligibility.

Baton’s Eligibility Service simplifies and streamlines the complex process of assessing collateral asset eligibility across diverse counterparty requirements for cleared derivatives, bilateral agreements, and tri-party arrangements.

With real-time insights on asset eligibility, fees, rates, and settlement windows, collateral managers can reduce errors and make confident, more informed funding decisions. Baton’s Eligibility Service transforms the process of eligible collateral evaluation, increasing speed, precision, and cost-efficiency for both cash and non-cash assets. Empowering financial institutions with unparalleled clarity and control, firms can optimise collateral allocations while driving superior operational efficiency and scalability.

Why Choose Baton for Eligible Collateral Evaluation?

Baton transforms collateral eligibility management with a streamlined platform that simplifies and automates complex collateral evaluation matching processes. Designed to accommodate intricate variations in eligibility criteria across venues, accounts, and product types, Baton ensures efficiency and precision at every step.

By normalising highly complex counterparty data, received in a wide range of formats with varying levels of detail and unpredictable update frequencies, Baton provides clear, consistent, and efficient access to counterparty schedules. Our advanced methodology ensures accurate evaluation of even the most complex schedules, supported by ongoing monitoring to ensure changes are rapidly identified and reflected. This commitment enables clients to evaluate collateral eligibility with confidence and ease.

Minimise Risk

Exposure

- The Eligibility service, integrated with Baton’s Core-Collateral Long Box, mitigates the risk of pledging ineligible or high-risk assets and their subsequent rejection or penalties. Instead, eligible assets can be clearly identified and secured in advance.

Real-time Collateral Asset Haircut and Fee Transparency

- Gain visibility into haircuts and fees imposed by counterparties on pledged assets.

- Evaluate interest rates offered by counterparties for cash assets to make informed decisions.

Optimise Collateral Management

- Seamlessly integrate the detailed information provided by Baton’s Eligibility Service into your optimisation processes. Elevate asset portfolio recommendations by ensuring they are based on accurate and well-informed eligibility assessments across venues and counterparties for the specific account and product type.

Enhanced Decision-Making and Cost Factor Analysis

- Automatically compare haircuts, collateral fees, cross-currency adjustments, and interest rates across counterparties to discover cost-effective opportunities that manual collateral eligibility assessments often overlook.

- Use counterparty availability data to optimise eligible collateral movements, avoid rejections, and calculate asset cost factors seamlessly.

- Ensure optimisation algorithms are using the most accurate and comprehensive collateral eligibility criteria.

Maximise Operational Efficiencies

- Introduce real-time, automated workflows and collateral eligibility checking processes to streamline operations and eliminate time-consuming manual tracking of collateral eligibility schedules.

- Access normalised counterparty eligibility schedules across multiple formats and channels and instant data on asset acceptability and haircuts across counterparties for faster decision-making – saving time and resources.

Effortless and Centralised Collateral Eligibility Evaluation

- Instantly access results such as haircuts, CUF (Collateral Utilisation Fees), interest rates, cutoff times, holiday schedules, and counterparty availability windows.

- Assess your lists of cash and non-cash assets to determine their acceptability as eligible collateral across multiple counterparty criteria.

- Alternatively, you can directly consume normalised eligibility schedules in your environment for interrogation by your optimisation tool, utilising your preferred integration format.

Streamlined Collateral Asset Data Access

- Provide end-users with access to asset-level data, including haircuts, while integrating with Core-Collateral’s Long Box and mobilisation engine for efficient management of counterparty availability and movement windows.

Seamless Integration Options for Eligible Collateral Management

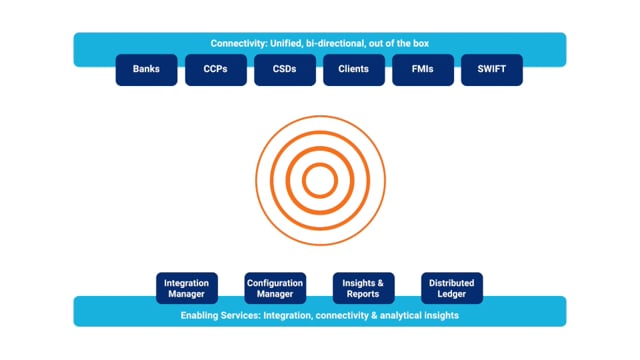

Baton’s cloud-native Eligibility Service has been designed to be interoperable, modular and extensible – so it can be deployed to support your business in the way you need it to.

Available as Part of Baton’s Core-Collateral Platform

The Eligibility Service seamlessly integrates with our Core-Collateral solution, providing users access to advanced collateral management features, including the Baton Longbox for consolidated asset data, optimisation to improve portfolio efficiency, and asset mobilisation capabilities for the efficient execution of movement instructions.

Discover Baton’s Core-Collateral solution: Fill out the form here to access our product information sheet.

Or Integrate with Proprietary or Third-Party Workflows

Do you already have workflows in other business areas where this service would prove beneficial? No problem.

Extensive integration capabilities lie at the core of our modular Eligibility Service, enabling clients to seamlessly embed the service into existing operations and both proprietary and third-party workflows in an interoperable manner for enhanced efficiency and collaboration via our advanced API.

Our Eligibility Service is just one of the modules available as part of our Baton CORE® platform.

Make Smarter Collateral Management Decisions

Optimise efficiencies, mitigate risk exposure, and enhance your decision-making with Baton’s Eligibility Service.

Request your demo today and take the first step toward effortless, real-time collateral management.