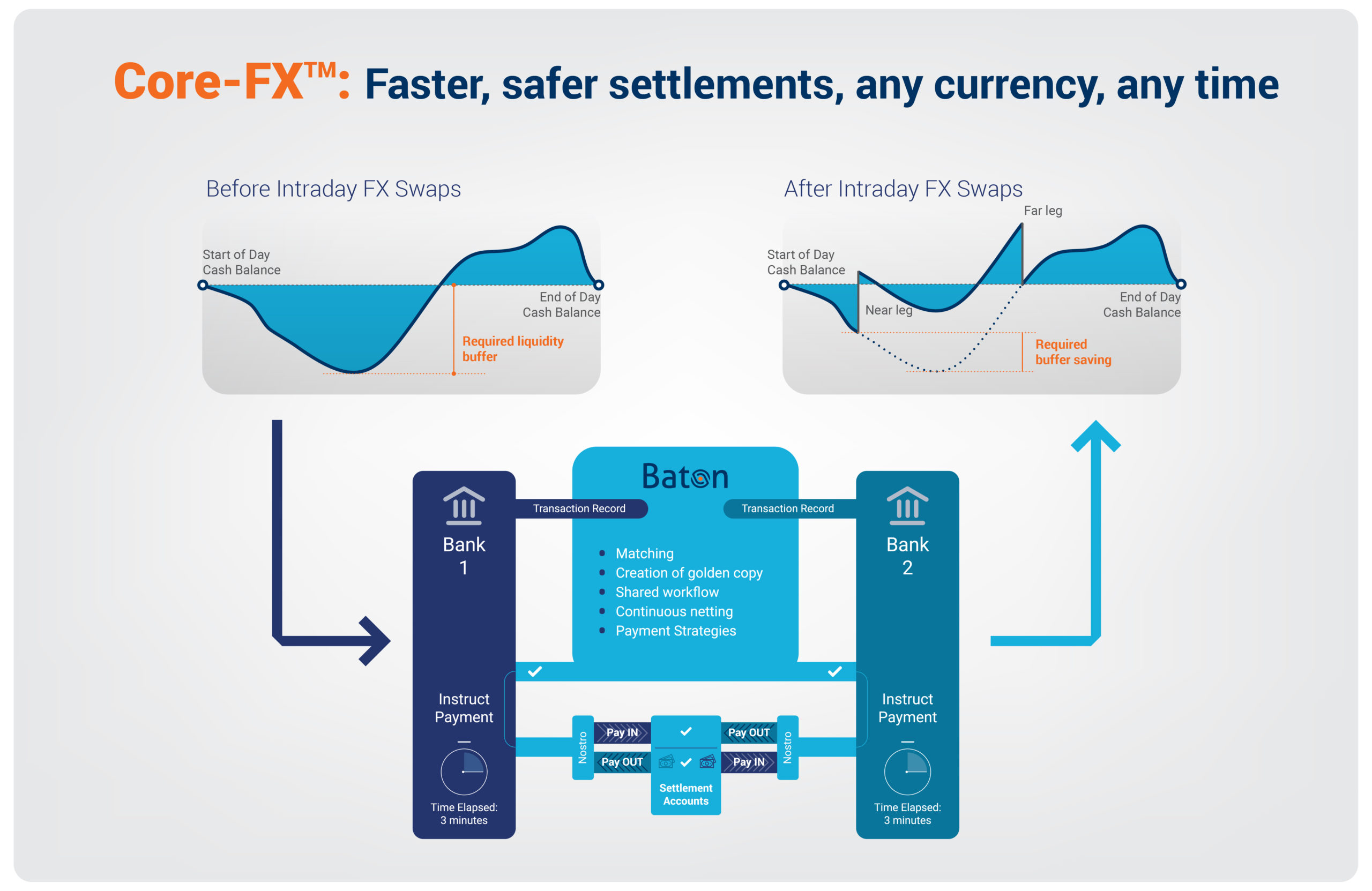

Firms could manage their funding positions more efficiently if they had the ability to transact and settle FX swaps on an intraday basis. Baton’s Core FX™ allows all FX market participants to settle any currency pair in under 5 minutes, at the time of their choosing, with any counterparty on a PvP basis.

FX swaps, like all other FX transactions, are defined by standard economic elements: they are pairs of trades between two counterparties with two cash flows (one in each currency) on each of two specified value dates. However, there is no obligation for counterparties to deliver at a particular time on that date.

There is now an opportunity for firms to enter into FX swap transactions where the settlement time is specified not merely by date, but also by time of day. An intraday FX swaps market would provide treasurers and intraday liquidity managers with access to an extra tool for the management of intraday cash flows.

Intraday FX swaps – why the interest?

This increased level of granularity in intraday FX swaps is attractive because it would allow firms to manage their funding position more accurately than they have so far been able to do. I’ve highlighted in a previous blog how important it is for banks to maintain the right level of funding in their nostro accounts: too little runs the risk of incurring expensive overdrafts, whereas too much is wasteful. In either case, a firm might attract negative attention from the regulators.

We know, then, that it’s important for firms to have the best possible visibility of their sources and obligations across the currencies that they manage – this can help them to plan for the funding that is required. However, in reality, even with this visibility, positions change throughout the course of the value date.

When this happens, adjustments need to take place. Either the person managing the account will have excess funds in a particular currency which need to be placed somewhere else or there will be a shortage of funds, in which case cash needs to be found in order to meet their obligations.

In a previous blog we outlined that Baton enables payments to be held back. Transacting in a market for intraday FX swaps provides an alternative to this – instead of holding back outgoing payments (potentially upsetting customers) the bank could swap in the currency needed and continue outgoing payments as normal. Having access to multiple approaches provides flexibility to bank treasury teams.

Conventionally banks with a nostro shortage or excess will go to the overnight repo or unsecured cash markets and borrow or lend funds as required. However, accessing the overnight market at short notice to address an intraday need can prove to be inefficient or expensive (think of booking a one-way flight with the assumption that you will be able to book a cheap return flight at a later date!) In the current interest rate environment, the costs can be even more pronounced. A straightforward alternative would be to enter into an FX swap with a trading counterparty where that counterparty is in the opposite position.

An FX swap has two legs which are (broadly speaking) equal and opposite from a notional perspective. The near leg could be effective immediately for settlement, while the far leg could be effective later in the day. For example, a bank which is short GBP could buy at 9am and sell back at 3pm with a counterparty with, say, USD on the other side, thereby managing its GBP balance for the course of that day and addressing any timing mismatches or short-term obligations from an intraday perspective.

What tools would be needed to facilitate intraday FX swaps?

Initiatives are underway aimed at reviewing the creation of a marketplace for the pricing and execution of FX swaps with a time element as well as a date element attached to the trade. As this marketplace takes shape, settlement is a vital component to be considered. Even if two counterparties enter into a transaction where the near leg is effective straight away and the far leg later in the same day, the counterparties need to effect settlement in order to give each of them the use of the funds which they require – this, after all, is the whole point of the transaction.

Using Baton’s settlement processes, one of the main obstacles to the opening up of this market can be overcome.

Already being used in a live production environment to settle FX transactions everyday, Baton’s Core-FX™ platform allows participants to settle any currency pair at the time of their choosing (including immediately) on a riskless (PvP) basis, with legally enforceable settlement finality and full transparency. The entire process from deal booking through to completion of settlement can take place in five minutes or less.

Furthermore, Core-FX is available to all market participants, extending the benefits of PvP settlement across any currency, and with no limitation on the number of currencies.

It’s worth mentioning that currently much of the attention on intraday swaps appears to be focused on the major currencies. However, at Baton we see an interesting use for settlement solutions like this across all currencies, including those that are less widely traded and have more restricted liquidity. In these cases, the costs associated with overdrafts are often higher and the regulatory pressure to ensure that nostro accounts are appropriately funded, more pronounced.

We hope that this blog has explained how Baton’s CORE technology could open up the opportunity for a robust and reliable settlement process for intraday FX swaps. Please reach out if you have any questions or would like further information by emailing [email protected].